After rallying through the summer, the market is back to its declining ways

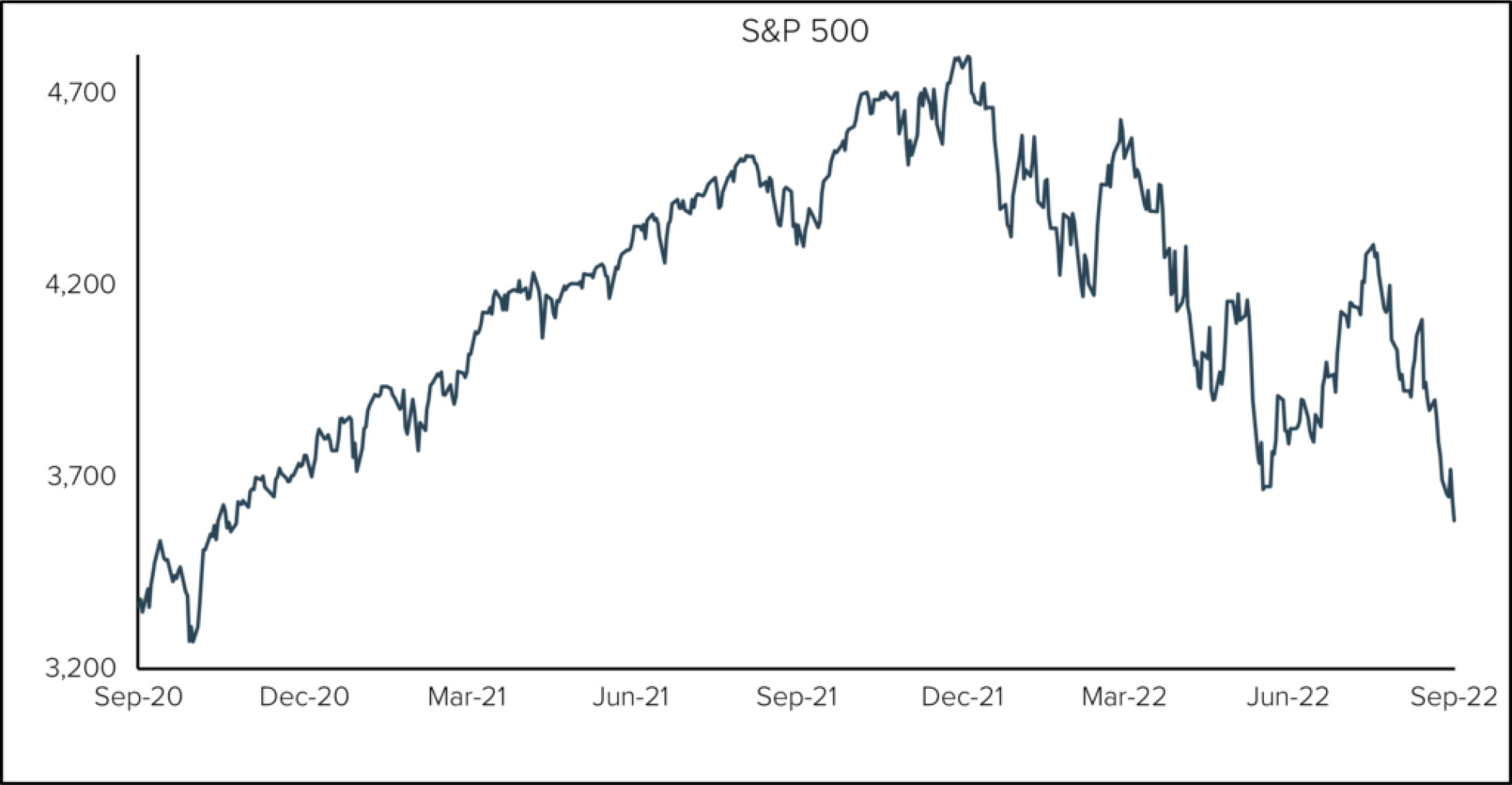

The third quarter of 2022 was a tale of two markets. From June 30th through August 16th, the S&P 500 rallied 14%. Things were actually starting to feel good again for investors. Surging yields and a robust dollar, both providing market headwinds throughout the year, cooled as stocks rose to a quarterly high on August 16th. Then, stocks stopped rising. Yields began surging higher once more, and the dollar continued its ascent. The index subsequently fell more than 17% through the end of the quarter. The S&P 500 closed the quarter lower and has now declined for three straight quarters – the first time since the heart of the Financial Crisis. Despite the big rally to start the quarter and the bigger decline to end the quarter, the S&P 500 fell only about 5%, though the volatility certainly made it feel worse than that for many investors.

The big story last quarter continued to be the Federal Reserve. The market rally to start the quarter coincided with a belief, or perhaps a hope, that the Federal Reserve would “pivot” and ease their relentless pace of rate hikes. Global central banks will raise rates in an attempt to cool the economies that they oversee. It’s a balancing act. Raise rates too far or too fast and a recession will likely follow. Raise rates too slow and inflation may begin to run rampant. That is where we find ourselves today. In hindsight, central banks and governments kept financial conditions too easy for too long. Money was too abundant, so naturally costs and asset prices rose globally. The debate now is whether or not they can raise rates to stop inflation without causing the economy to recess. Throughout the first half of the year, media conversation was centered on the idea that the Fed could “engineer a soft landing”. In other words, the media focused on the Fed’s goldilocks ability to raise rates “just right” to end inflation and stave off a recession. Today the possibility of a goldilocks Fed appears unlikely. A recession, depending on who you ask, has already started, or is surely to start soon.

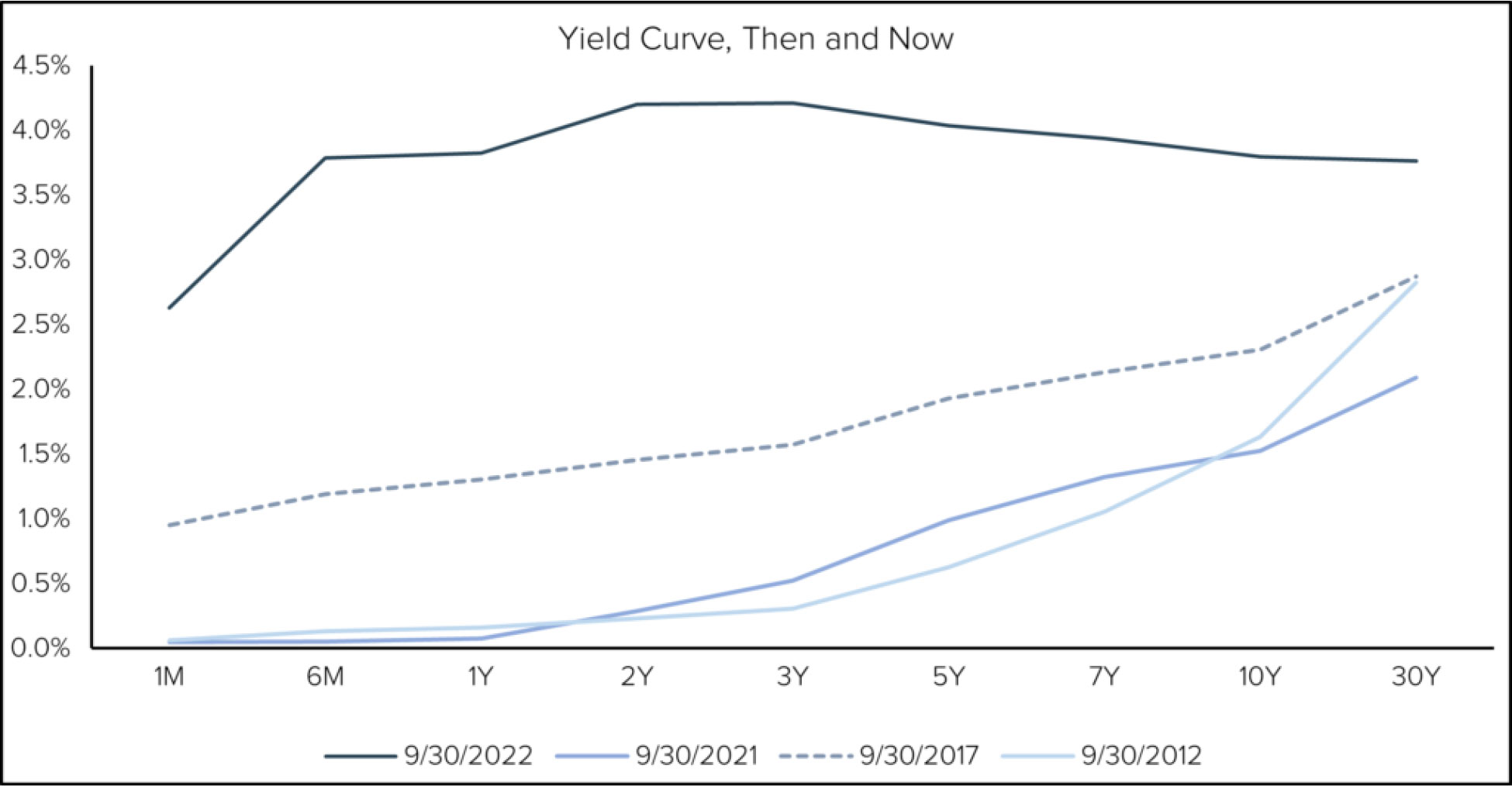

Usually, as recessionary fears feed through the market, interest rates will drop. Interestingly, that has not been the case this time around. The rapid rise in interest rates over the past year has been breathtaking and market changing. The 2-year U.S. Treasury was yielding just 0.29% a year ago. 12 months later and that yield had increased to 4.20%. Rates have risen in response to the action out of the Federal Reserve as well as the anticipation of future action out of the Fed.

The rise in the Fed Funds rate has caused ripples to more than just the 2-year Treasury and has begun impacting consumers. Look no further than mortgage rates, which are at their highest levels since 2007. Corporate yields, which can be viewed as the price a company must pay to borrow, have been rising as well. That can impact a company’s ability to spend on projects, reinvestment, hiring, etc. Rising rates, which tend to slow economic growth, tend to hurt corporate profits as well. Coupling rising rates with a slowing economy can create an environment that is very difficult for companies to navigate and maintain their profitability. All in all, falling profitability, continued inflation, surging yields and a stronger dollar have weighed on the market in one way or another this year.

The recent decline in stocks and the rising recessionary debate have led to the permeation of fear in the stock market. More recently, rumors of an unhealthy European bank and markets “breaking” in the U.K. have been winding through financial circles. Tandem’s Billy Little summed it up best in his most recent Observations,

The recent issues in the U.K. government bond market and rumored trouble with a couple of large European banks have people in fear that “something is about to break.”

This phrase about “something breaking” is being muttered across every financial media outlet and it is instilling flashbacks of 2008. There is a significant amount of recency bias considering it really wasn’t all that long ago when global financial markets were breaking. The fear is understandable, but probably a little misplaced. Not all financial stress or even a failing bank has to lead to a global financial crisis. It would likely lead to more volatility in financial markets, but it doesn’t mean all businesses are no longer a going concern.

Billy, as usual, likely has it right. There probably is some recency bias that is clouding investor sentiment and judgment. The Financial Crisis was not so long ago. It has been only 14 years since the global financial system was almost brought to its knees and the S&P 500 fell 50+%. It’s been only 22 years since the Tech Bubble burst and then the felling of the Twin Towers led to a ~50% decline as well. Those scars are still fresh. Those were extreme events though. They were not the norm. In fact, since 1928, the S&P 500 has fallen 40+% from an all-time high to its trough just four times.

Regardless and luckily, at least in Tandem’s opinion, we do not invest “in the stock market”. Tandem invests in individual businesses that have historically demonstrated the ability to grow consistently over time, regardless of the economic backdrop. Over the long run, we believe that the stocks of these individual companies will rise and fall based on their own merits, not because of the stock market. Several different risks like expensive valuations, rising interest rates, a surging dollar, waning profitability, and rising geopolitical tension, to name a few, have caused this market to tumble. But not every market fall or stumble needs to be the Financial Crisis. Not every bear market has to fall 50%. Bear markets can create opportunities. This bear appears to us to be no different.

Tandem believes part of its job is to be investing in consistent companies at reasonable prices. In doing so, Tandem (or really any investor) ought to buy low and sell high. Over the past 12 months ended September 30, 2022 the S&P 500 is down 15.47%. It is safe to say that the markets are lower than they were one year ago. It is also safe to say that there are more opportunities to be found in this environment today for those looking to “buy low”. Bear markets are never fun. They can be painful. They can be stressful. And they can be scary. They can also be a terrific time to invest for a long-term investor when suitable to do so. Could this market fall further? Certainly so. Perhaps even likely so. That does not mean that every single stock will fall further, or that every single stock will fall as much as the market. Some will fall more. Some will fall less. Some have already fallen and found their lows. That’s the beauty of being a patient bottom-up investor. We invest in individual companies when they appear to us to be attractive and worthy of purchase. Not because the market is doing this or that, and not because the Federal Reserve may raise or may pivot… but because a good company is worth owning at a reasonable price.

Ben Carew, CFA

Commentary

Focus on the company, not the economy

It is far easier to have conviction about a company than an economy. Many successful investors do, in fact, focus on the big, or macro, picture. So this is not an attempt to criticize those with a macro approach toward investing. Instead, we believe that focusing on the macro often leads to confusion, guesswork, and emotional decisions. You doubt this?

Has the market bottomed, or is there more downside yet to come? Will interest rates go higher, or will the Fed back off? Are we headed into a recession, or are we already there? If we do enter a recession, will the Fed lower rates, or will they keep them high? How does the strength of the dollar impact our economy? What about the European economy, or the debt crisis in the U.K.? And the list goes on. Knowing with certainty the answers to any of these questions, let alone most or all of them, requires some skill set few possess. And therefore we are left with confusion, guesswork and emotion. How much stress do you feel right now, worrying about how all of these things might impact your portfolio? Has emotion affected your decision making?

Emotional decisions are rarely good decisions. Deciding whether you should be out of the market, in our view, is unproductive. If you need your money soon, it probably never should have been invested in the first place. If you need your money to grow and/or produce income, you should be thinking about how much risk is appropriate, not whether you should be in or out. You can stay invested and still manage risk.

We have spoken about risk often in these pages over the years. With the benefit of hindsight, we now know the U.S. stock market was at its riskiest on January 4th of this year. On that day, the S&P 500 enjoyed another record close, one that would prove to be its last. In the moment, few perceived that day would be the last record high or that the market would proceed to lose a quarter of its value. It was nearly impossible to discern what would unfold.

For anyone that did get out of the market on or around January 4th, congratulations, maybe. But when will you get back in? Only when that is done successfully have you succeeded as a macro investor. But that is likely temporary, as repeating that over the next market downturn is highly unlikely for even the most experienced macro investors.

During the COVID decline, the S&P 500 lost 34% of its value in 22 trading days. It was a steep and scary decline. Many could not handle their emotions and got out of the market. On the 23rd trading day, the S&P rose nearly 10%, and the bull market was back. For those that got out, getting back in at our below where they exited proved extremely challenging. Many did not trust the rally, and therefore waited. Some never got back in.

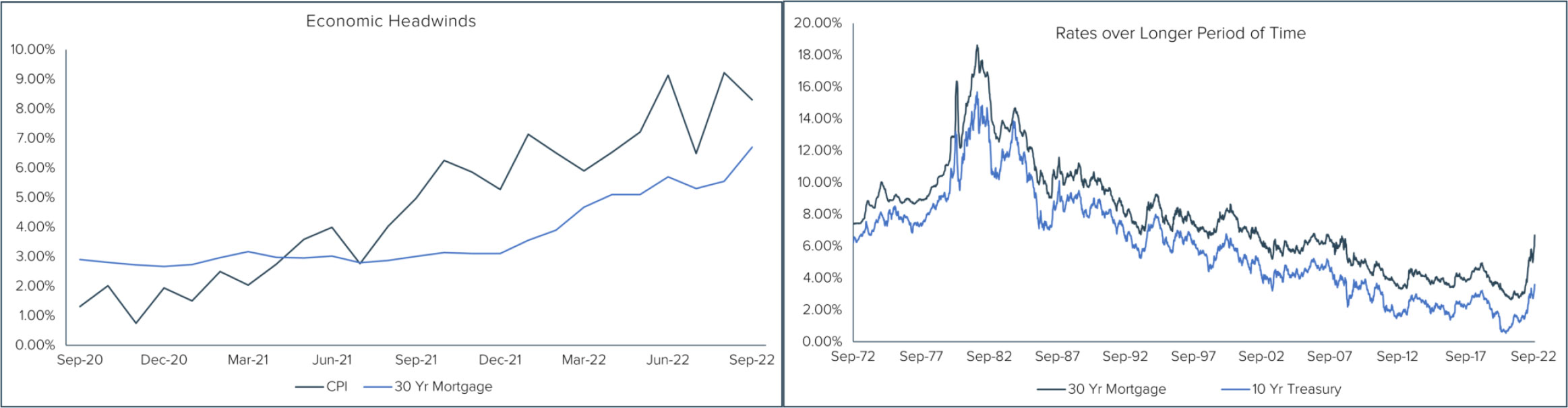

Letting emotion guide your decisions is a bad strategy. Nearly all the news today seems bad. The chart below on the left shows just how dramatically CPI and mortgage rates have risen over the last two years. The chart on the right indicates how substantially interest rates have advanced. This data is enough to give anyone pause. However, when viewed through a different prism, the data seems less challenging. The chart to the right Illustrates interest rates over the last 50 years. Rates have generally been much higher than they are now, and somehow our economy managed to survive and thrive.

It is our opinion that it is difficult to have any sort of conviction about markets and the economy when viewed through a macro lens. On the other hand, it is much easier for us to feel conviction about a company. Remember, as a shareholder in the Castle Tandem Fund you are not invested in “the market”. Instead you are invested in a focused portfolio of companies. We added these companies to the Fund because they have demonstrated the ability to produce a track record of growth through all sorts of headwinds. The market’s volatility should not be a cause for concern. It should be viewed as an opportunity. Focus on the company, not the economy.

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The Standard & Poors 500 Index (S&P 500) is an index of 500 stocks.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877-743-7820 or visiting www.castleim.com. Read it carefully before investing.

Important Risk Information

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Distributed by Arbor Court Capital, LLC – Member FINRA / SIPC

Comments are closed.