Financial Markets Review

The hopefulness surrounding the mid-summer rally has officially dissipated as the S&P 500 closed out September by setting a new year-to-date low and ending down six of the past seven weeks. Looking out a little bit further, the S&P 500 has now declined for the second straight month and for the third straight quarter. To make matters worse, there were few places to hide. Broadly speaking, both bonds and commodities suffered sharp declines. And home prices, as measured by the S&P Case-Shiller Index, have begun their descent from recent highs as the 30-year fixed mortgage rate closes in on 7%.

The most recent weakness is nothing new and shouldn’t come as a surprise. We’ve been on record for a year now saying that financial market valuations needed to correct. The surge in almost all financial assets post the initial COVID lockdowns was not normal, and it certainly was not sustainable. Money was so abundant and cheap that demand was pulled way forward, and prices went through the roof. We are all adjusting to a more normal world where capital has a cost and that involves a reset in asset prices.

A valuation reset is never going to be easy. If you own an asset, you don’t want it to go down in value. But there are times when it is healthy for risk assets to decline in the short-term in order to preserve long-term stability. The issue today is not necessarily the decline, but the speed of the decline in certain assets, which don’t normally experience this type of volatility that has markets rattled. Historically, government bonds of developed countries have acted as a volatility buffer in times of financial stress. Today, they are not only failing to provide that buffer, but they are rather a source of the volatility. The recent issues in the U.K. government bond market and rumored trouble with a couple of large European banks have people in fear that “something is about to break.”

This phrase about “something breaking” is being muttered across every financial media outlet and it is instilling flashbacks of 2008. There is a significant amount of recency bias considering it really wasn’t all that long ago when global financial markets were breaking. The fear is understandable, but probably a little misplaced. Not all financial stress or even a failing bank has to lead to a global financial crisis. It would likely lead to more volatility in financial markets, but it doesn’t mean all businesses are no longer a going concern.

Last month, I wrote that we were not through with this bear market, and I still believe that. The economy is showing increasing signs of slowing down and a greater number of companies are revising down earnings guidance. Investor sentiment surveys are at some of the most depressed levels on record and many sell-side strategists have finally thrown in the towel and cut their S&P 500 year-end price targets. Fear is becoming pervasive, but it’s not yet entrenched. When the equity markets start moving up and down 5+% in a day, because that is what we believe can happen amid real fear, then we believe we are nearing an end. We believe these are all signs you need to see before a credible bottom can be put in place. So, we are getting closer, but not quite there yet.

Castle Tandem Fund Update

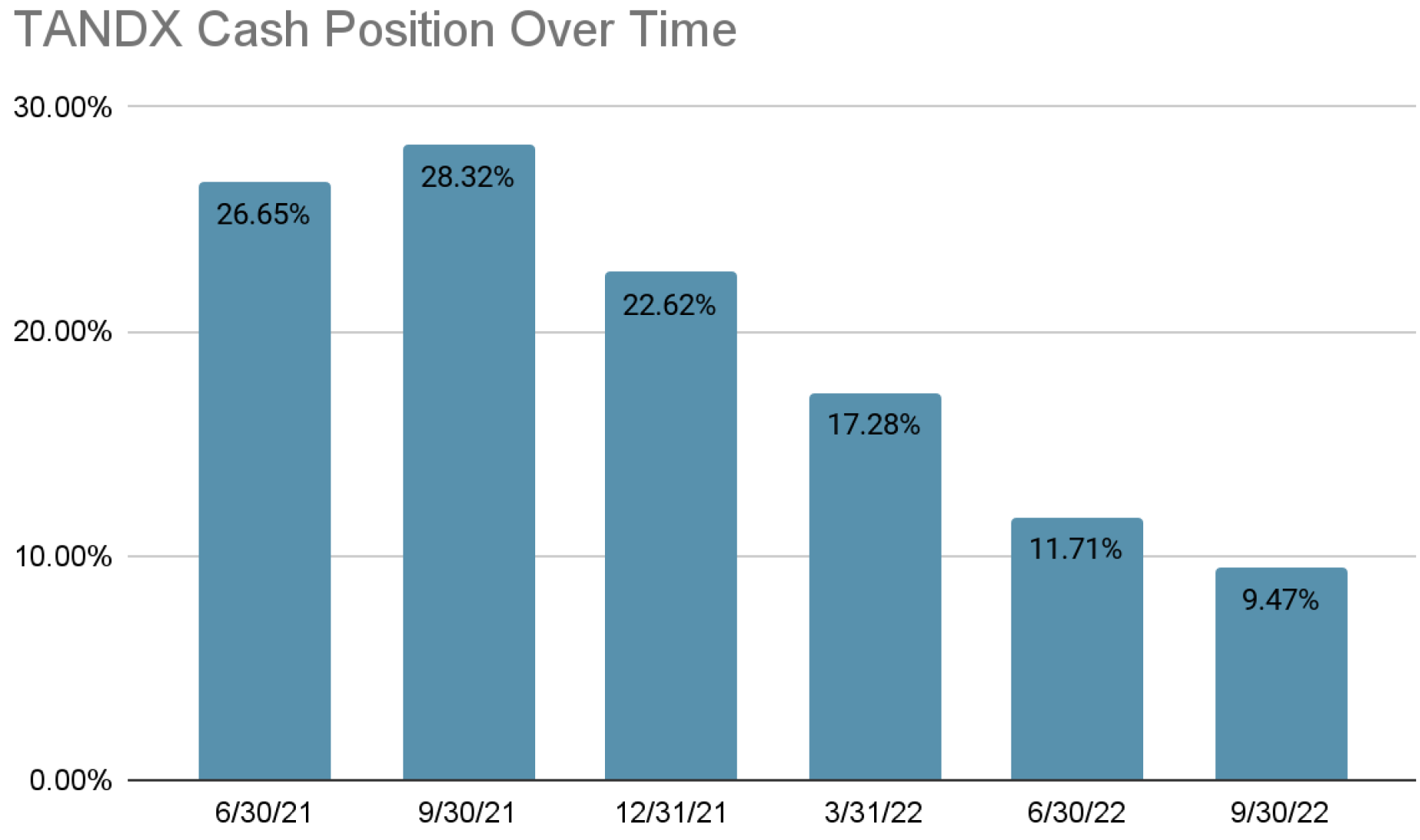

However, soon after those rallies, markets retreated once more and gave us the opportunity to invest cash into new positions and add to existing positions. In some cases, we’ve had the opportunity to pare back and add to the same company within months of each other, because that is what the market gave us. You have to be nimble and disciplined to take advantage of those opportunities, because they tend to be fleeting. As we’ve seen, markets are more volatile and move faster in a bear market, but with that more opportunities are present.

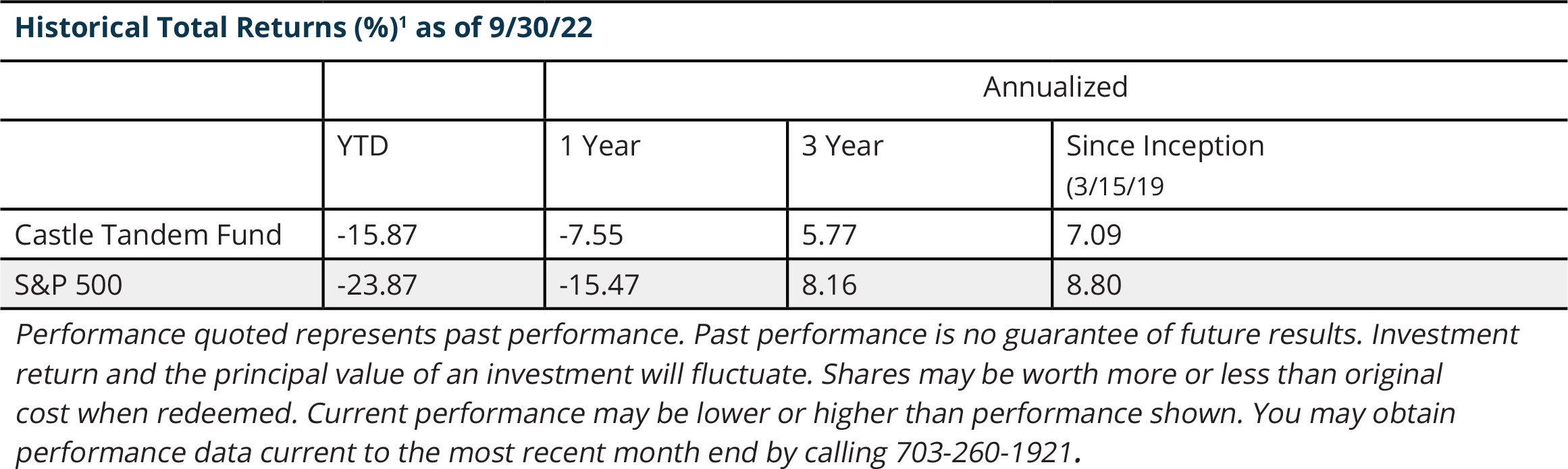

Given the S&P 500 ended September down over 9%, which stands shoulder-to-shoulder with the declines witnessed during the Septembers of 2001, 2002 and 2008, there certainly were opportunities to put some cash to work. You will recall those months did not mark the bottom in their respective bear markets, but they also weren’t terrible times to incrementally invest in specific individual companies if you took a longer-term view. Last month, we took the opportunity to reinvest most of the cash that was raised throughout the summer rally.

In September, we did add one new company to the Castle Tandem Fund – STERIS (STE). STERIS is a leading global provider of products and services that support patient care with an emphasis on infection prevention. The next time you are in your doctor’s office or at the dentist, look around and you will see something with STERIS on it. STE is one of those companies that has been on our “watchlist” for quite some time, and we finally got the opportunity to begin the process of building a position. The company has consistently grown revenues, earnings, and cash flow. As a result of this consistent growth, STE announced a 9% increase to their dividend, which marked the 17th consecutive year of dividend growth.

As financial markets continue down the path of volatility and uncertainty, we will continue to be very active. There will be times we are selling and there will be times we are buying. However, the goal of this activity is to be opportunistic and position the Castle Tandem Fund in a way that we believe will lead to long-term success.

1 The expense ratio for the Institutional Share Class is 1.20%. Effective November 1, 2021 the Adviser has contractually agreed to waive Services Agreement fees by 0.40% of its average daily net assets through October 31, 2022. The Services Agreement fee waiver will automatically terminate on October 31, 2022 unless it is renewed by the Adviser. The Adviser may not terminate the fee waiver before October 31, 2022. The waiver may be terminated by the Board of Trustees.

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The Standard & Poors 500 Index (S&P 500) is an index of 500 stocks. The S&P Case-Shiller Index is a composite tracking the value of existing single-family housing within the United States.

As of September 30, 2022 the Castle Tandem Fund held the following positions mentioned in this report: Steris PLC (STE, 1.47% of Fund total net assets).

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877-743-7820 or visiting www.castleim.com. Read it carefully before investing.

Important Risk Information

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Distributed by Arbor Court Capital, LLC – Member FINRA / SIPC

Comments are closed.