Financial Markets Review

The unwavering grind higher continued through April. U.S. equities posted their third consecutive month of gains and have now closed higher in five of the last six months. Large cap companies fared the best as the DJIA, S&P 500 and Nasdaq gained 6.62%, 5.24% and 5.40%, respectively. After outpacing all U.S. indices in the first quarter of this year, small cap stocks, as measured by the Russell 2000, have taken a bit of a breather, but still managed to post a relatively modest gain of 0.88%.

As has been the case for several months, the path of least resistance continues to be higher. Central bank liquidity does not appear to be abating any time soon, as the combined G5 central bank balance sheet now stands at roughly $30 trillion. And calls for even more fiscal stimulus seem to ring louder with every passing day. One thing that I believe everyone can agree on is that there certainly is no shortage of liquidity in the system.

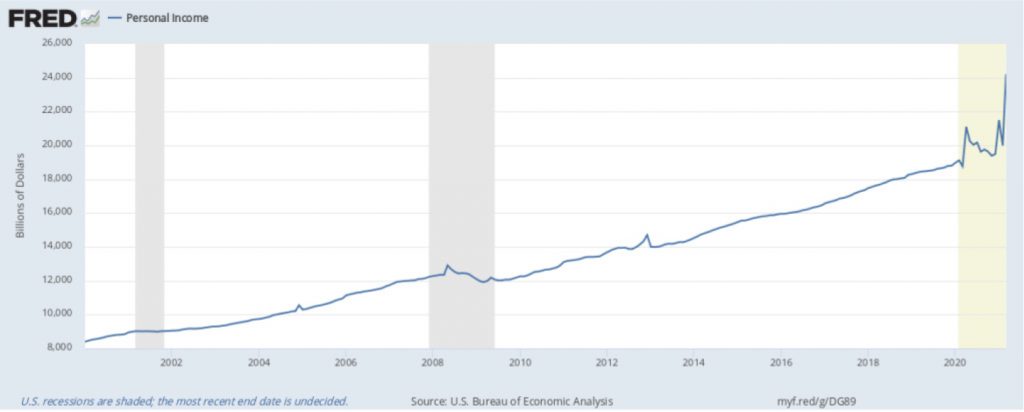

The most recent personal income report is evidence that cash is abundant. Personal income surged 21.1% in March to a record high as the latest round of stimulus checks hit bank accounts. The graphic below shows personal income nearly jumping off the chart.

Source: US Bureau of Economic Analysis

This staggering jump in income also comes at a time when nearly 9 million individuals who had a job before the pandemic hit still find themselves unemployed. It is truly heart-warming to see the amount of support given when people needed it the most and, in many cases, continue to need it. In fact, the COVID-19 recession is the first one where personal incomes rose during an economic contraction as opposed to falling.

In fiscal year 2020, the federal government ran a deficit of $3.1 trillion. To put this into perspective, it was more than triple the size of the deficit in 2019. And so far, six months into fiscal year 2021, the federal government has run a deficit of $1.7 trillion. The CBO is projecting a $2.3 trillion deficit this year and another $1.9 trillion in 2022. As the deficits keep on stacking, the federal debt continues to swell. The longer the government runs a deficit, the longer the Federal Reserve stays in the picture. After all, to keep interest rates from spiking higher, you need someone willing to soak up the debt. We have gotten to a point where we are trapped in a never-ending cycle of stimulus. It is hard to envision a way out.

And therein lies the rub – something must give. We are living in this goldilocks world where everything seems too good to be true. Personal incomes are higher, the largest asset on household balance sheets, real estate, is higher and equity markets are higher. According to JPMorgan Chase, stocks now make up 41% of U.S. households’ total financial assets, which is the highest level on record. The previous peak was 38% and that was set at the height of the Tech Bubble.

The risks, specifically to equities, are present. However, the risks will largely be ignored and will not matter until they do. Mike Tyson once famously said, “Everybody has a plan until they get punched in the mouth.” You do not need to be that person who gets punched in the mouth. Your plan should weigh the known risks in the market, and your portfolio should be adjusted accordingly.

Corporate Earnings Update

Much has been made of the unbelievably strong corporate earnings reports, and rightfully so. After the first few days in May, 69% of S&P 500 companies have reported aggregate revenue and Earnings per share (EPS) growth of 11% and 52%, respectively. Those are jaw dropping numbers with Q2 estimates looking even better. Analysts currently project S&P 500 earnings to report 18% revenue growth and 59% EPS growth next quarter. Those growth numbers will do a lot in tempering the significant overvaluations we see in many companies today.

However, what one needs to consider, and prudently so, is how sustainable these growth numbers will be in the future. The hype around the economy opening back up is very real. The pent-up demand is not a farce and the cash is there as measured by the recent spike in personal income and consumer spending.

Again, something must give. As we have seen demand return, signs of a notable labor shortage have appeared. Corporations need to hire in a big way and the only way to bring employees back is to make it worthwhile for them to abandon government support they receive. Couple higher labor costs with skyrocketing commodity/input costs, which are now making their way into financial statements, and what you get are declining margins. Oh, and do not forget about taxes, as we believe it is with almost 100% certainty that those are going higher in order to offset some of the additional fiscal stimulus.

We think the growth trajectory we are on is unsustainable. As we lap the easiest comps over the next two quarters, a more realistic growth picture will emerge. It will likely not be one in which earnings grow 52% off the back of 11% revenue growth. The easy money has been made and it is now time to consider the risks in equities as we transition to an environment that is hopefully more sustainable.

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The Standard & Poors 500 Index (S&P 500) is an index of 500 stocks. The Dow Jones Industrial Average is a stock market index that tracks 30 large, publicly traded companies. The Nasdaq Composite Index is a market-cap weighted index of more than 2,500 companies listed on the Nasdaq stock exchange. The Russell 2000 index measures the performance of the small-cap segment of the US equity universe.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877-743-7820 or visiting www.castleim.com. Read it carefully before investing. Distributed by Rafferty Capital Markets, LLC Garden City, NY 11530.

Important Risk Information

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Comments are closed.