Market Commentary

June 15, 2020

“In these matters, the only certainty is nothing is certain.”

Pliny the Elder

According to FactSet, nearly two-thirds of companies in the S&P 500 who provide earnings guidance have withdrawn their fiscal 2020 guidance. On June 5th, the May nonfarm payrolls report showed jobs increasing by 2.5 million with an unemployment rate of 13.3%. This came against expectations for a loss of 8.5 million jobs and the unemployment rate spiking to 19.6%. To put it plainly: estimates for the foreseeable future will be an exercise in futility.

The S&P 500’s historic decline has been well documented. It took a mere 22 days for the index to fall over 30%, the fastest drop of this magnitude in history. The subsequent ascent has been just as remarkable. In fact, the S&P 500 recently posted its largest 50-day rally on record – a 37.7% increase. Ryan Detrick, of LPL Financial, crunched the numbers and noted that the previous seven largest 50-day rallies in the S&P 500 all produced positive returns over the following 6 and 12 months. It’s easy to see how one could easily conclude that if history is any indication that equity prices are in the clear.

I will readily admit that I do hope history repeats itself. However, I have a hard time putting faith in future outcomes based on historical relationships because we seem to be making history (record equity decline, record equity rally, record monthly job loss, and record monthly job gain) every day. Even investor sentiment surveys are at odds with one another, as my partner Ben Carew wrote last month:

Some gauges of sentiment, like the AAII Investor Survey, show that investors are still markedly bearish while other metrics such as Citi’s Panic/Euphoria Model suggest that investors are overly bullish. Bank of America Merrill Lynch’s Fund Manager Survey even offers conflicting views within its own survey! According to the survey, cash allocations are unusually high. However, managers cited the “most crowded trade” as being long U.S. tech and growth.

Ben Carew, CFA

Furthermore, the Investor Intelligence Survey is reporting that bulls outnumber bears by 2.26x and the CNN Fear & Greed Index just ticked into “greed” territory from a “neutral” reading earlier in the week. It is safe to say that wherever one might fall on the bull to bear spectrum, their conviction is likely to waver.

The uncertainty surrounding our economic, social, health and political future is so extreme that it would be foolish to try and predict where we are headed. What we do know is consumption and production completely dried up as the economy was forced to shut down. However as the economy reopens, there will be an initial economic surge from almost two months of pent up demand. The million-dollar question remains: to what level of economic activity do we initially return, and will there be structural changes that prevent a return to pre-Covid-19 levels in a timely manner?

Castle Tandem Fund Update

The past few weeks have been quiet on the strategy front. That being said, based on a quantitative signal, we made a meaningful increase to the Fund’s position in Essential Utilities (WTRG). Outside of this purchase, the other activity in the Fund were liquidations due to a fundamental violation – specifically, the suspension of dividends. We have recently liquidated the Fund’s position in Walt Disney (DIS) and Ross Stores (ROST).

Some could say that these circumstances are extraordinary and maybe our dividend policy should be adjusted to reflect the environment in which we find ourselves. I would agree but only to a certain extent. This time is different, and many businesses are doing the prudent thing by eliminating, cutting, or suspending their dividend until the dust settles. These actions do not make them bad businesses at all. The issue remains: how are we expected to apply our dividend discipline in the future? How are we to know when we should ignore or follow our discipline? The answer is we should not deviate because we should be following it. The reason for a dividend cut or suspension is usually one of the first signs of dire prospects ahead for the company. By no means do we want to be a part of that, which is why we liquidate. In this current environment, I can see a scenario where several of our holdings suspend their dividend, not because of a dire road ahead, but as an exercise of caution. The problem therefore is that we can’t know if the dividend suspension is being done out of good business practice or if the business is in trouble.

Personally, I think Disney and Ross Stores still have a bright future. I see how much content is consumed in my house and how eager my kids are to get to the parks; I have a hard time believing the Disney brand is in danger. Ross Stores has an intriguing business model that is centered around an experience – a “treasure hunt” – that is much more appealing than going to a more structured retailer. There is no room for opinion and bias in our investment process. The foundation of our investment discipline is to remove emotion from our process and to let the numbers dictate our actions. Part of our investment discipline is to liquidate a company from our strategy if they no longer consistently grow their dividend. However, for a company to consistently grow a dividend, they must start with paying the dividend. Disney and Ross Stores recently announced they will be foregoing their next dividend payment to conserve cash due to the lingering uncertainty from Covid-19.

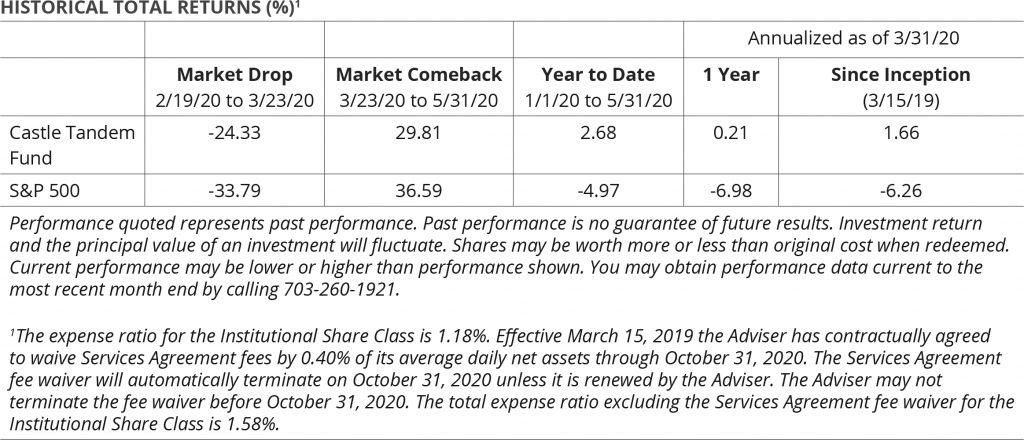

We take great pride in our investment strategy and discipline. The most important part of our job is to make sure we stay true to our word and strive to provide a consistent investment experience. Volatility is an investor’s enemy because it makes us all want to do the wrong thing at the wrong time for the wrong reason. Our attempt to limit volatility – both downside and upside – is done to try to provide a more consistent experience — one which can help investors limit emotions from dictating their investment decisions.

To all the financial professionals and clients who have hired us – thank you for believing in and supporting our investment strategy. Above all else, thank you for entrusting us with your hard-earned money during this unprecedented time.

Billy Little, CFA

Lead Portfolio Manager

Castle Tandem Fund

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

As of March 31, 2020, the Castle Tandem Fund held the following positions mentioned in this report: Essential Utilities (2.09% of Fund total net assets); The Walt Disney Co. (1.75% of Fund total net assets); Ross Stores (1.25% of Fund total net assets).

The Standard & Poors 500 Index (S&P 500) is an index of 500 stocks.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877- 743- 7820, or visiting www.castleim.com. Read it carefully before investing. Distributed by Rafferty Capital Markets, LLC Garden City, NY 11530.

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Comments are closed.