TANDX::Institutional Shares

Financial Markets Review

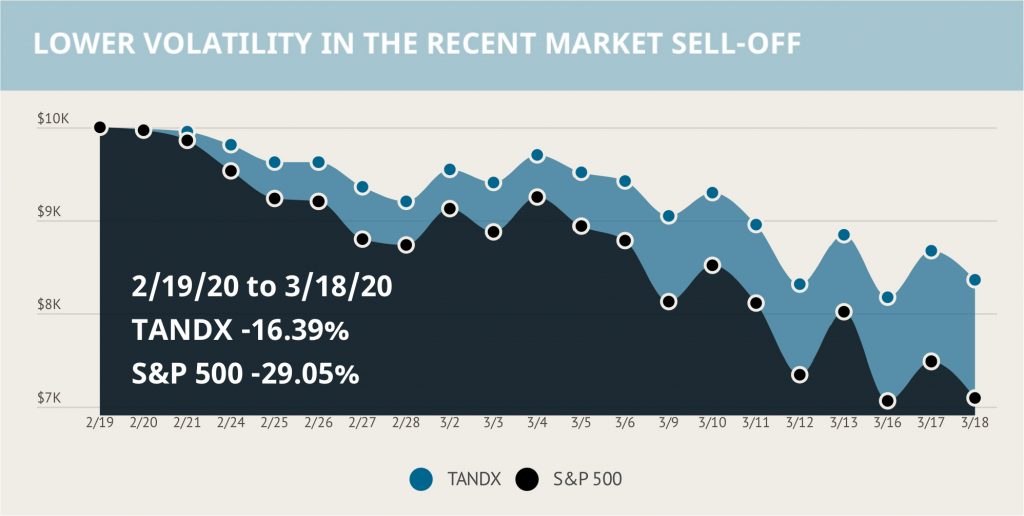

There are a million superlatives one could use to describe the state of the financial markets, but to save time let’s just call it as we see it – markets have crashed. Over the past two weeks, we have witnessed some of the largest single day swings on both the upside and downside. The violence and velocity of these swings only compare to the moves seen during the 2008 Financial Crisis, 1987 Market Crash, and the Great Depression. Technically, the move in equities over the past 3 weeks are on a whole different level, as this market sell-off has been the fastest on record. In a mere 16 trading days, the S&P 500 fell more than 20% from all-time highs. The confidence that market participants were feeling not all that long ago feels like an eternity ago. Confidence and exuberance have swiftly been replaced by panic and fear.

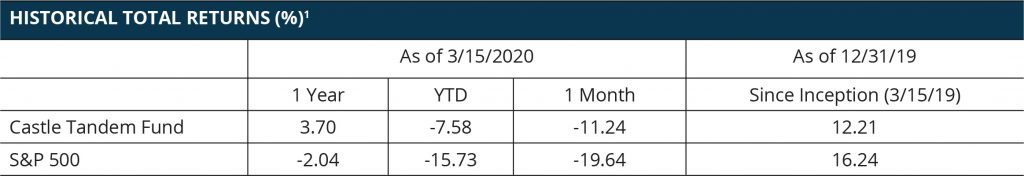

Performance quoted represents past performance. Past performance is no guarantee of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Current performance may be lower or higher than performance shown. You may obtain performance data current to the most recent month end by calling 703-260-1921.

Performance quoted represents past performance. Past performance is no guarantee of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Current performance may be lower or higher than performance shown. You may obtain performance data current to the most recent month end by calling 703-260-1921.

1 The expense ratio for the Institutional Share Class is 1.18%. Effective March 15, 2019 the Adviser has contractually agreed to waive Services Agreement fees by 0.40% of its average daily net assets through October 31, 2020. The Services Agreement fee waiver will automatically terminate on October 31, 2020 unless it is renewed by the Adviser. The Adviser may not terminate the fee waiver before October 31, 2020. The total expense ratio excluding the Services Agreement fee waiver for the Institutional Share Class is 1.58%.

All markets – equities, fixed income and commodities – are signaling that we are either in a recession or one is right around the corner. With people hunkering down, businesses temporarily closing and countries closing off their borders, it is safe to say a recession is indeed inevitable. The average peak-to-trough of the S&P 500 during a recession is 30% over the course of 15 months. The S&P 500 was a mere few basis points from closing 30% below it’s peak set not even one month ago. There are a few factors I can point to that would suggest not hanging one’s hat on the “averages”. The current sell-off is likely to be much worse and speedier than what took place during past recessions. On the flip side, the recovery could very well be equally as fast.

The first reason for the sheer velocity of this sell-off compared to ones during past crises has to do with the increased adoption of electronic and algorithmic trading. Computers can move prices far faster than a human can ever react. Over the past several years, beginning with the Flash Crash on May 6th, 2010, we’ve seen the progression of electronic trading exacerbate equity, fixed income, commodity and currency markets on both the upside and downside. Second, the rise of passive investing has taken over the investment community by storm. The onslaught of ETFs and the popularity of passive investing hit its peak just as markets were hitting all-time highs. Just like every market, if it’s going up, everything is alright. The minute the market turns against you, the first thing to be sold is what you don’t understand. That obscure ETF or even plain vanilla index ETF became a prime target for liquidation. Whether you are buying or selling these products, you are doing so by essentially indiscriminately buying or selling the securities in these products. This leads to mass accumulation or liquidation of all companies regardless of their fundamentals. Just as these factors have aided in the speed of this current market move, it is likely these factors will lead the market higher just as quickly once the future becomes more certain again.

Central Bank Action

Many financial pundits are trying to compare the current crisis to past crises. The problem is that every crisis is different, so there is no script to follow to see how this will all unfold. However, one of the central themes in two of the largest financial crises – Great Depression and ’08 Financial Crisis – was the seizing up of credit and the failure of financial institutions. Never say never, but right now we are not experiencing a credit event. Credit markets are tightening, as they always will during periods of financial stress, but there is a big difference between tight credit and no credit or liquidity.

I believe the Federal Reserve has learned from the past and knows their only job right now is to offer up liquidity and keep credit markets moving.

On the night of March 15th before futures began trading and Asian markets opened, the Federal Reserve announced extraordinary measures to keep credit markets from seizing. During the Financial Crisis, banks failed because they couldn’t get overnight lending and individual investors were hurt when certain money market funds “broke the buck” and funds were frozen. In order to avoid a repeat of this, the Federal Reserve has gotten out in front by taking rates to 0%, launching QE and injecting nearly a trillion dollars into the repo market. Some might say given that U.S. equity markets fell +10% the day after such extraordinary measures were taken, markets no longer believe in “Fed put”. We contend that view is a bit shortsighted. The only job of Central Banks right now is to keep liquidity flowing. The Fed’s actions are not going to get people outside to spend money and that is why this crisis is a bit different than the others. This is a demand issue, not a credit issue. And the only thing to make markets stabilize and to get volatility to settle down is for the virus and associated health scare to go away. The Fed can’t do this. However, as long as the Fed can keep the financial “plumbing” from getting clogged up, the amount of monetary and likely future fiscal stimulus to come will make this market come roaring back once we are given the all-clear to resume our daily lives.

Castle Tandem Fund Update

At this point, you are probably wondering what we are doing at the strategy level and how the Fund is positioned moving forward. We came into this market slide with a rather significant amount of cash. On February 19, 2020 the Fund held 28.34% in cash or cash equivalents. We have used that cash as the market tumbled by adding a few new positions and incrementally adding to some of our existing Fund holdings. By no means are we indiscriminately buying, but rather we are trying to be as opportunistic as possible.

A little more than three weeks ago the Fund held close to 30% of its assets in cash while the S&P 500 was setting record highs. Over the past few weeks, we’ve invested roughly a third of that cash, as cash levels hover just under 20%. This first tranche of buying was us following our discipline and acting on the buy signals generated by our quantitative model. Our model has identified several companies trading at valuation levels that we have not witnessed for quite some time and we took that opportunity to put a little cash to work.

Now that more news has come out about businesses shutting down and commerce coming to a halt, we’ve started to implement a tweak that we first adopted just before the 2008 Financial Crisis. Currently, earnings estimates have not been ratcheted down all that much, even though I can say with a lot of confidence that businesses will earn less next quarter than they did last quarter and even less than they did during this same quarter one year ago. Earnings are headed lower — we have very little doubt about it. So, what we’ve done is gone through each of our current holdings and the companies on our watchlist and discounted future earnings. If we value a company today based on lower future earnings, we’ve given ourselves added cushion against market volatility. The next thing we’ve done is applied company specific valuation levels based on where some of these companies have traded in the past, such as during the Financial Crisis, to get an idea of how far a company’s valuation could theoretically fall. This gives us our second buffer. By applying discounted earnings coupled with historically low valuations, we are giving ourselves a rather high bar when investing the Fund’s’ cash. Having these new buffers in addition to our already disciplined approach allows us to take comfort in the numbers and stick to our discipline during highly emotional times.

So, to just quickly summarize, we are still sitting on a significant amount of cash in the Fund waiting to take advantage of the expected continued volatility in the equity markets. Our discipline and process are rooted in numbers that allow us to remove the daily emotional grind the stock market can dish out. We remain disciplined and steadfast as we judiciously manage the Castle Tandem Fund during these difficult and stressful times. Just like all crises before it, this too will pass.

Billy Little, CFA

Lead Portfolio Manager

Castle Tandem Fund

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877- 743- 7820, or visiting www.castleim.com. Read it carefully before investing. Distributed by Rafferty Capital Markets, LLC Garden City, NY 11530.

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Comments are closed.