TANDX::Institutional Shares

Observations: Markets, Valuations and Tandem

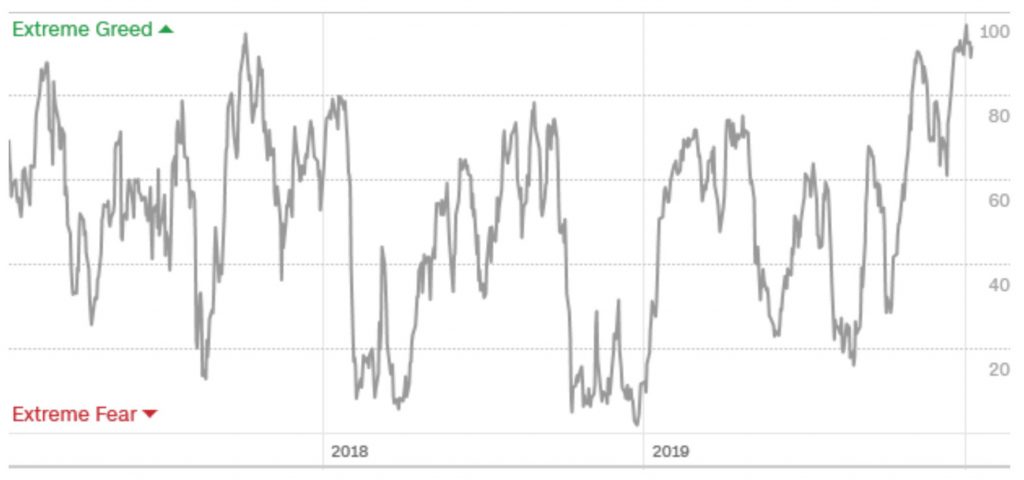

As the ball dropped in Times Square this past new year’s eve, the mood on Wall Street could not have been any more different than a year ago. A chart showing the CNN Fear & Greed Index says everything you need to know about the state of the investor then and now.

Source: https://money.cnn.com/data/fear-and-greed/

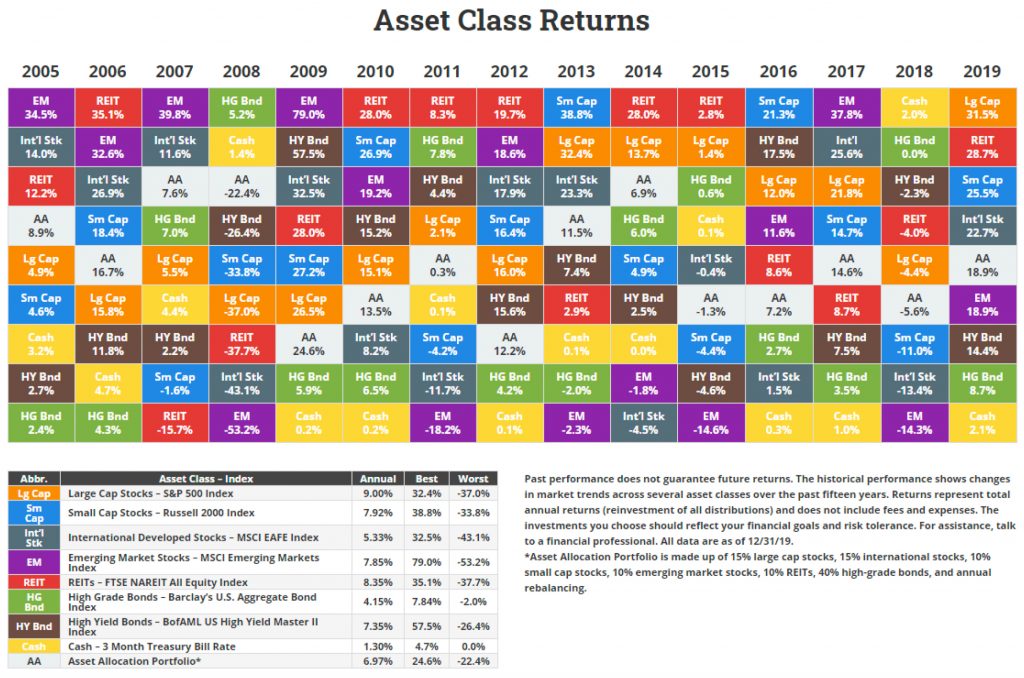

As 2018 came to an end, nearly every major asset class, except for cash, had gone down in value. In 2019, the script was flipped, and you would’ve been hard pressed to lose money.

Source: https://novelinvestor.com/download-returns-tables/

The two images above remind me of a quote from Seth Klarman – founder and CEO of Baupost Group. The last time I wrote about this quote was nearly one year ago to the day…

“On several occasions throughout 2017 and 2018, I used a quote from Seth Klarman who is the founder and CEO of Baupost Group. In those cases, it was used to iterate how the pervasive bull market and lack of volatility presented great risk to investors. Today, we are in a very different environment. Our process and quantitative model have identified that now is the time to selectively start deploying some of our clients’ cash as the long-term risk/return profile is much more favorable today than in the past.

‘When share prices are low, as they were in the fall of 2008 into early 2009, actual risk is usually quite muted while perception of risk is very high. By contrast, when securities prices are high, as they are today, the perception of risk is muted, but the risks to investors are quite elevated.’ – Seth Klarman, Founder, CEO, and Portfolio Manager of Baupost Group”

Human nature wouldn’t have you believe this, but actual risk is much higher today than it was 12 months ago. After a nearly 20% drop in Q4’2018, the perceived risk was off the charts, which is clear as day in the Fear & Greed chart; however, the actual risk of losses escalating from that point were quite low. It was at that time and during Q1 2018 that our quantitative model had us investing our clients’ cash. The exact opposite can be said right now. The perceived risk is very low after a 31.5% return in the S&P 500 Total Return Index, because our recency bias says markets will continue going higher. In reality, the actual risk is quite high right now.

A couple of months ago, I wrote about valuations being stretched and specifically highlighted future returns when the Price to Sales (P/S) ratio was at the then current level of 2.14. With future returns being a function of the price you pay today, it was not a surprise to see that future returns were mostly negative over the ensuing 1-year, 2-year and 3-year time periods. Today, the P/S ratio stands at 2.27. The S&P 500 is 3% away from trading at the same valuation we last saw in January 2018, right before the market fell nearly 12% over the span of 10 days. The current P/S ratio is also roughly 10% away from valuation witnessed at the height of the Tech Bubble.

I bring attention to these things, not because my goal is to instill fear in the individual investor, but rather to shed light on where we are in the most recent market cycle. It is very easy to get caught up in the moment and lose track of your surroundings. Watching an investment pay off is a lot of fun and extremely rewarding; however, it is equally, if not more rewarding, to not give it all back. It is impossible to predict the market’s next move, which is why you shouldn’t be “all in” or “all out”. As discussed last month, seasonality and momentum can trump rationality and valuation any day of the week. And for this reason, it should come as no surprise to see the market continue to climb higher. However, at some point the risk begins to outweigh the reward and I suspect we are inching ever closer to this point.

In managing the Castle Tandem Fund, we have seen our cash position increase over the last several months. As many buy signals as we had in December 2018, we are getting an equal number of sell signals today. Discipline drove our investment actions a year ago with us putting cash to work and it’s that same discipline that drives our actions today. Patience will ultimately be rewarded and without dry powder available, it’s hard to take advantage of attractive opportunities when they arise.

Billy Little, CFA

Lead Portfolio Manager

Castle Tandem Fund

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The price-to-sales (P/S) ratio is a valuation ratio that compares a company’s stock price to its revenues. It is an indicator of the value placed on each dollar of a company’s sales or revenues.

https://www.investopedia.com/terms/p/price-to-salesratio.asp

Tech Bubble. 1995-2002. The dotcom bubble, also known as the internet bubble, was a rapid rise in U.S. technology stock equity valuations fueled by investments in internet-based companies during the bull market in the late 1990s. https://www.investopedia.com/terms/d/dotcom-bubble.asp

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877- 743- 7820, or visiting www.castleim.com. Read it carefully before investing. Distributed by Rafferty Capital Markets, LLC Garden City, NY 11530.

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security

Comments are closed.