TANDX::Institutional Shares

The Importance of Staying Invested

Let’s be clear, 2019 will be a year to remember for equity investors. Not only did the S&P 500 return more than 30%, but it grew more than 8.5% in Q4 alone! What a difference a year makes. One year ago, the S&P 500 was staring down the barrel of a 14% drop in Q4 and a 20% drop from all-time highs set in September of 2018. Fear was running rampant. The Federal Reserve was thought to be misfiring and guiding us directly into a recession, while the trade war was grinding global economies to a screeching halt. The S&P 500 dropped 9.18% in December 2018 alone, finally bottoming on Christmas Eve. Happy Holidays indeed!

However, the real tragedy did not lie in the 9% December decline, nor even in the 20% fall from all-time highs. Surely those losses hurt investors far and wide. But, no, the real tragedy lay in the fact that in December of 2018 there were net outflows for equity investments. In other words, people were selling at or near the bottom! Investors are supposed to sell high, but too often emotion gets in the way and they do the wrong thing.

Here is some data worth noting. According to Morningstar, December 2018 was the worst period in terms of monthly outflows for U.S. equity funds since October 2008. For those keeping score at home, October 2008 was the worst month the S&P had seen since Black Monday in October of 1987. The December 2018 drop was the worst decline for the S&P 500 since the Financial Crisis.

To state the tragedy clearly, investors were selling their stocks at unprecedented rates during two of the biggest monthly declines in over 30 years. Somewhere along the way investors must have forgotten that people ought to buy low and sell high. Historically, one of the best times to buy is when the market is gripped by fear. Similarly, periods of excessive optimism, like the ones we witnessed in stocks in the late 90’s or in housing in the mid-2000’s, are the times to sell risky or overvalued assets.

It’s a bit of a contrarian notion to sell when others are buying and buy when others are selling. But it is the only way to proactively buy low and sell high! To do otherwise and act after the market moves is reactionary. Reacting to what has already passed rarely prepares us for what may come.

Intellectually we all know this. Yet time and again most fail to comprehend their error in the moment. Emotion gets in the way. When prices are high and rising, most tend to feel better about the market and so they perceive less risk because the market is going up. When prices fall, investors react as if risk were actually increasing. In fact, lower prices equal less risk, but fear can make this hard to act upon.

All sorts of studies show that too often the worst enemy of investors is themselves. Investors repeatedly succumb to fear – both of missing out and of further losses. The fear of missing out is evident in the increased buying typically witnessed at market tops. Attempts at market timing by the average investor often cause them to miss out on a lot of return over the long-term.

According to a recent report by the research firm Dalbar, Inc., the average equity fund investor at the end of 2017 realized an annualized return of 5.29% for the previous 20 years. This trailed the S&P 500’s return by nearly 2 full percentage points. Let’s consider a hypothetical scenario. Investing $100,000 at a 5.3% rate of return for 20 years would lead to a portfolio worth $280,910. Not bad! However, investing $100,000 at a 7.3% rate of return for 20 years would lead to a portfolio of more than $400,000!

The cost of attempted market timing cannot be understated! Per Morningstar, from 1997-2017 the S&P 500 grew at an annualized rate of 7.2%. However, if you missed the 10 best up days during those 20 years, you would have only earned 3.5%. If you had missed the 50 best up days, you would have lost money at an annualized rate of -4.5%! It is amazing to consider that being absent for the 50 best up days of the market would result in a negative 20 year return.

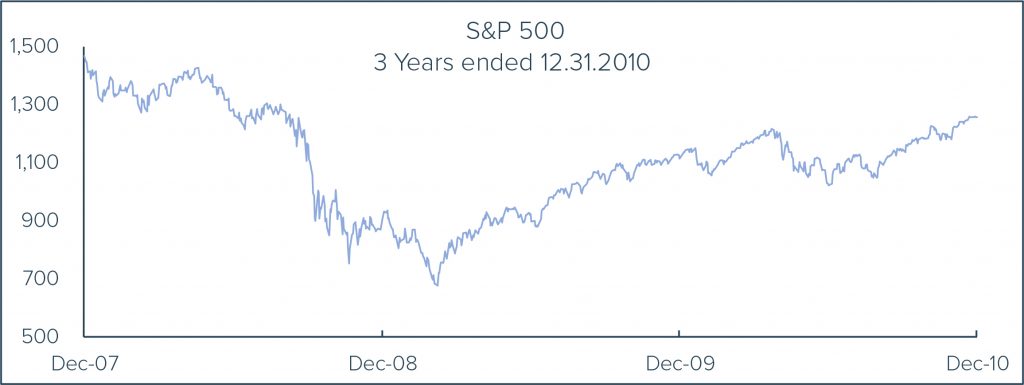

Worse still, most of the best up days occur near market bottoms. In other words, those investors that attempt to time rarely do so successfully. For those that panic and sell at the bottom, their losses are magnified. Had they simply waited a few months, most of their losses would have been recovered. The chart below shows the market’s extreme decline in 2008 and early 2009. Most of the selling occurred in October of 2008. Had investors simply stayed the course, most of their losses would have been recovered within the next 24 months.

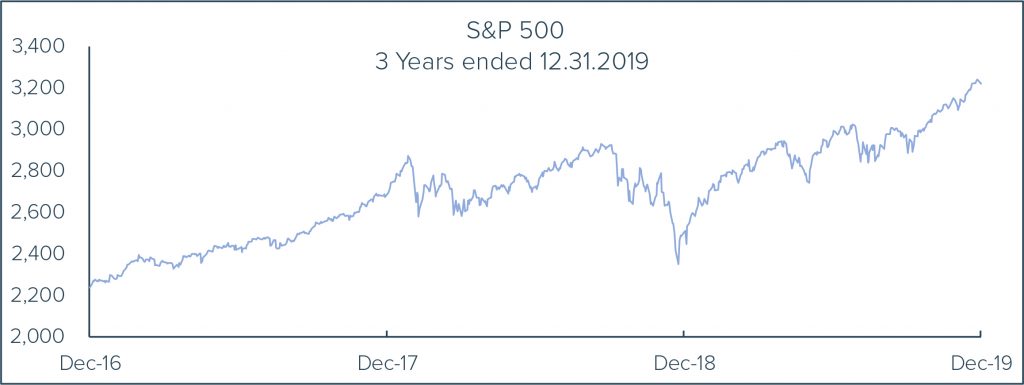

The same is true for the market sell-off in 2018. Again, the heaviest selling was at an inopportune time – in December. As the chart below indicates, those that sold in December may have felt better initially, but they missed out on a wonderful 2019!

However, it is not all bad news. For one thing, we are merely discussing averages and the average retail investor. That surely does not include the readers of this newsletter! Second, studies also show that what investors struggle mightily with is volatility. According to the aforementioned Morningstar study, the difference between actual investor returns and market returns is the best when investors hold funds with low volatility. Not surprisingly, the difference between actual and market returns is the worst when investors rely upon highly volatile funds.

Volatility is the enemy of the average investor because it makes us all want to do the wrong thing at the wrong time for the wrong reason. But what do we mean by volatility? Simply put, it is a measurement of price fluctuation. The more dramatically the price of an investment moves, the greater the volatility of that investment. Sometimes volatility results from prices going dramatically higher. This would certainly seem to be a good thing, and it is for those who already own the investment as the price rises. The problem lies in the temptation for those that do not already own the investment to get on board after that train is well down the tracks! That is why people too often buy high – because they are following what has already happened. Unfortunately, when volatility is to the downside, the same sort of temptation to get on board doesn’t seem to exist, and so investors shun the opportunity to buy low. But if they own the investment that has declined considerably, the temptation to get rid of it rises. And so they sell low.

In other words, if a fund, or portfolio, exhibits limited volatility, an investor is more likely to stay invested in the strategy and experience all of the investment’s return. More highly volatile funds are more likely to find investors entering and exiting at inopportune times, and therefore the typical investor experiences returns less than the investment’s actual performance.

At Tandem, we strive to produce market-like (or better) returns with less volatility. We think that over time, achieving market-like returns with less volatility will allow individual investors to more fully participate in the upside that equities offer. Lower volatility will make investors less likely to capitulate and give in to the emotional decisions that cause investors to sell low or buy high. If one is invested in a less volatile portfolio, there is no need to fret over the Dow being down 500 or even 1,000 points. Because if you are less volatile, you will not look like, nor act like, the Dow, the S&P 500 or any other index. You will be able to remain calm while others panic.

Investing can be a bit like the Tortoise and the Hare. Trying to mimic the Hare might give one a big lead out of the gate. However, just as the Hare stops for a nap and gives up its lead, the market often gives up its lead as well. So, while the Tortoise might not always be the in-vogue choice, time and again slow and steady wins the race.

By strictly adhering to our discipline, we strive to produce a consistent and repeatable experience for shareholders of the Castle Tandem Fund. Of course, there will be times when we trail the market as there will be times when we beat the market. Our goal is to consistently follow our process, so that shareholders stay invested and experience the long-term returns that too many investors seem to miss. Staying invested is the key to investment success. Limiting volatility is the key to staying invested.

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877- 743- 7820, or visiting www.castleim.com. Read it carefully before investing. Distributed by Rafferty Capital Markets, LLC Garden City, NY 11530.

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Comments are closed.