Market Comments

“Memory is the diary that we all carry with us.”

Oscar Wilde

Do bad memories fade away faster than good memories? In fact, they do according to many studies. Psychologists had long observed man’s proclivity to ‘forget’ bad memories while more easily recalling the pleasant ones. Numerous studies1 cited this cognitive bias as universal among humans and found examples independent of geography, culture, race, sex or age.

To download a PDF of this report, click here.

The first study on this phenomenon began in the 1930’s. That and future studies confirmed the existence of “The Fading Affect”, a bias to more quickly forget memories associated with negative emotions than memories associated with positive emotions. However, a study in 1997 attempted to quantify that bias. That study2 had 1,200 participants and found that at a fixed point in time negative memories were “forgotten” 51% of the time while positive memories were forgotten only 37% of the time.

The results of the multiple studies suggest that our ability to tuck away the bad memories in a distant corner of our mind goes to the most basic of human instincts: survival. The rationale goes like this: Positive thoughts and memories make us happy. Happiness leads to good health. Good health leads to a long life. Actress Ingrid Bergman echoed the findings of the studies when she quipped “Happiness is good health and a bad memory.”

While people may want to forget bad memories themselves, they expect certain people in their lives to remember and learn from those painful times for them. We inherently understand that there are very valuable lessons to be learned from these painful episodes. We expect our doctors, for example, to maintain a long, good memory of unfortunate events and how to prepare for and respond to a reoccurrence. Financial Advisors and professional money managers are rightly held to the same standard.

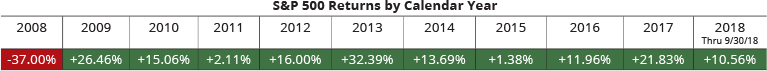

When we launched the Castle Focus Fund in June 2010 the painful memories of 2008 were still fresh. Our approach to investing shareholder capital is to strive to participate sensibly when markets move up and to be prepared for market downturns. In 2010, investors understood that this conservative approach to equity investing made sense. We are proud that many of those same early investors in the Fund remain with us today. With each passing year, however, unhappy memories of 2008 lose their currency and have been replaced with more recent – and happy – memories.

When asked what lessons investors could learn from 2008 and the financial crisis, Jeremy Grantham of GMO famously replied:

“In the short-term a lot, in the medium term a little, in the long-term, nothing at all.”

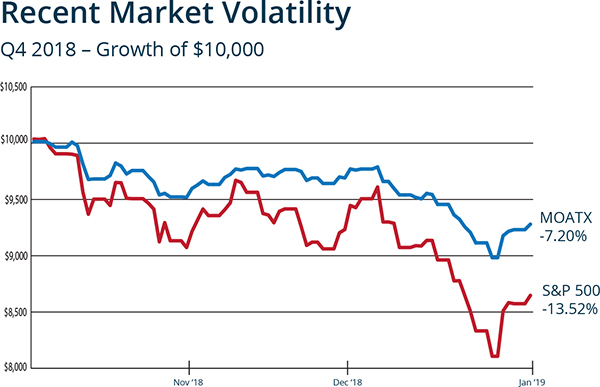

Mr. Grantham understood the cognitive bias that the psychologists observed in their studies and what Ingrid Bergman was getting at. Investors are humans and humans want to be happy. Spending your time and energy to focus on painful investment memories – even if valuable lessons are to be learned – is difficult for most investors. As the adviser to the Castle Focus Fund, we are paid to remember these valuable lessons and to prepare the Fund for market downdrafts. This past quarter reminded investors that markets can move down very suddenly.

Where markets go from here we do not know. What we do know is that the concerns that we have accumulated over the past several years have not been allayed. We continue to invest your capital with an ever-mindful eye toward risk.

Portfolio Overview

Buys and Sells

During the last quarter of 2018 we initiated two new positions in the Fund. DowDuPont, Inc. (1.78% of Fund assets at 12/31/18) and Equity Commonwealth (0.99% of Fund assets at 12/31/18).

Cash

The Fund’s cash position (cash and cash equivalents) on December 31, 2018 was 27.85%, slightly higher than where we ended the prior quarter.

Risk and Volatility

For the five years ending December 31, 2018, the Fund’s beta was 0.52, roughly half that of the S&P 500. For the same period, our standard deviation was 6.71% versus a S&P 500 standard deviation of 10.95%. Up Capture versus the S&P 500 for the five year period was 56.08% and down capture was 58.14%.

Regards,

![]()

Caeli Andrews

Managing Director

Castle Investment Management

Andrew Welle

Managing Director

Castle Investment Management

The opinions expressed are those of the Fund’s Adviser and are not a recommendation for the purchase or sale of any security.

The Standard & Poors 500 Index (S&P 500) is an index of 500 stocks.

Beta is a measure of the Fund’s sensitivity to a benchmark or broad market index which has a beta of 1.00. Standard deviation is used to measure an investment’s historic volatility. The up capture and down capture ratios are statistical measures of a manager’s overall performance in upward moving and downward moving markets, respectively.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The Prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877-743-7820, or visiting www.castleim.com. Read it carefully before investing.

The expense ratio excluding acquired fund expenses for the Investor Share Class is 1.34% (2.34% for Class C). The expense ratio including acquired fund expenses for the Investor Share Class is 1.40% (2.40% for Class C). Effective November 1, 2018 the Adviser has contractually agreed to waive Services Agreement fees by 0.24% of its average daily net assets through October 31, 2019. The Services Agreement fee waiver will automatically terminate on October 31, 2019 unless it is renewed by the Adviser. The Adviser may not terminate the fee waiver before October 31, 2019. The total expense ratio excluding the Services Agreement fee waiver for the Investor Share Class is 1.64% (2.64% for Class C).

The risks associated with the Fund, detailed in the Prospectus, include the risks of investing in small and medium sized companies and foreign securities which may result in additional risks such as the possibility of greater price volatility and reduced liquidity, different financial and accounting standards, fluctuations in currency exchange rates, and political, diplomatic and economic conditions as well as regulatory requirements in foreign countries. There also may be risks associated with the Fund’s investments in exchange traded funds, real estate investment trusts (“REITs”), significant investment in a specific sector, and nondiversification. Technology companies held in the Fund are subject to rapid industry changes and the risk of obsolescence. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund.

Distributed by Rafferty Capital Markets, LLC-Garden City, NY 11530.

Comments are closed.