Market Comments

“A penny saved is a penny earned.” Benjamin Franklin

“The waiting is the hardest part.” Tom Petty and the Heartbreakers

Delayed gratification is a concept studied in the field of psychology in which a subject forgoes an immediate reward and instead receives a later reward. The later reward is generally viewed as better than the immediate reward. The concept has been observed and tested in many academic studies. The Stanford Marshmallow Test is the most famous of the experiments on delayed gratification:

The seminal research on delayed gratification – the now-famous “marshmallow experiment” – was conducted by Walter Mischel in the 1960s and 1970s at Stanford University. Mischel and his colleagues were interested in strategies that preschool children used to resist temptation. They presented four-year-olds with a marshmallow and told the children that they had two options: (1) ring a bell at any point to summon the experimenter and eat the marshmallow, or (2) wait until the experimenter returned (about 15 minutes later), and earn two marshmallows. The message was: “small reward now, bigger reward later.” Some children broke down and ate the marshmallow, whereas others were able to delay gratification and earn the coveted two marshmallows.1

To download a PDF of this report, click here.

Some of the academic studies on delayed gratification added an interesting twist: Years after the study was complete, they went back to the subjects who participated in the tests. What they found was that those subjects who excelled in delaying gratification during their childhood had a greater chance of experiencing success later in life. The ability to delay gratification at an early age paid dividends later in the form of academic success, financial success and good health.

Financial advisors have a front-row seat in the battle between immediate small reward and delayed large reward. They see the long-term benefits that their clients accrue by investing early in life. They see delayed gratification at work when a client continues to invest during market downturns.

The financial advisors we work with use the Castle Focus Fund as a piece of client portfolios. We understand that these diversified portfolios are built to provide clients with strategies that may move differently depending on the market environment. Some of the strategies used are more growth-oriented, some more focused on value; some may focus on larger companies while others invest in smaller companies. We believe that most strategies available in mutual funds today are surprisingly undiversified in one respect: they focus on the immediate gratification of short-term relative returns. Our approach to investing makes the Castle Focus Fund different — we focus on the deferred gratification of long-term absolute returns. This difference — absolute returns versus relative returns — is most noticeable in our approach to buying securities. We believe that entry price is a key determinant of total return. Because of this, we typically invest in a company when its stock is trading at a sizable discount to our estimate of its fair value. In essence, we are taking positions and patiently waiting for the “second marshmallow”. As an example, during the second quarter of 2018 we added just one position to the Fund’s portfolio: Walt Disney Company (DIS, 2.04% of Fund assets on June 30, 2018). We added Disney when its stock was trading at an attractive discount to our estimate of its fair value. We find Disney attractive for many reasons, but this metric summarizes our investment thesis nicely: Disney’s market capitalization was recently eclipsed by Netflix. However, Disney’s 2017 free cash flow almost equaled Netflix’s 2017 top-line revenue number.

Our patient approach may not currently make for interesting cocktail conversation. Of course, market direction can change and a significant pullback in the market may make our strategy more conversation-worthy.

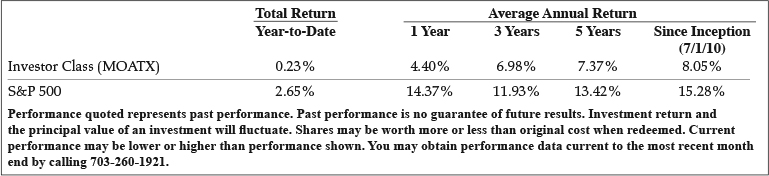

We are willing to look different — the Castle Focus Fund is a concentrated portfolio of 22 holdings and cash. The benefit to clients is that the Fund moves differently than many other mutual funds. This difference can be complementary and is one of the reasons we are an effective tool for financial advisors as they build diversified portfolios for their clients. Of course, it is easy to say you are different. But can you substantiate it over a long period of time? Our risk metrics do set us apart: The Castle Focus Fund is half as volatile as the S&P 500 with a five year beta of 0.50 (as of June 30, 2018). The Fund’s down capture for the same five year period is 56.69 versus the S&P 500.

1 https://en.wikipedia.org/wiki/Delayed_gratification

Portfolio Overview

Buys and Sells

During the second quarter of 2018 we added Walt Disney Company (DIS, 2.04% of Fund assets as of 6/30/18). We sold our position in Monsanto Co.

Cash

The Fund’s cash position (cash and cash equivalents) on June 30, 2018 was 30.94%, slightly lower than where we ended the prior quarter.

Regards,

![]()

Caeli Andrews

Managing Director

Castle Investment Management

Andrew Welle

Managing Director

Castle Investment Management

The opinions expressed are those of the Fund’s Adviser and are not a recommendation for the purchase or sale of any security.

The Castle Focus Fund does not own shares of Netflix, Inc.

The Standard & Poors 500 Index (S&P 500) is an index of 500 stocks. Beta is a measure of the Fund’s sensitivity to a benchmark or broad market index which has a beta of 1.00. Standard deviation is used to measure an investment’s historic volatility. The up capture and down capture ratios are statistical measures of a manager’s overall performance in upward moving and downward moving markets, respectively. We define a full-market cycle as a period of time, usually measured in years, that includes both ‘bearish’ markets (the market trends down) and ‘bullish’ markets (the market trends up).

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The Prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877-743-7820, or visiting www.castleim.com. Read it carefully before investing.

The expense ratio excluding acquired fund expenses for the Investor Share Class is 1.34% (2.34% for Class C). The expense ratio including acquired fund expenses for the Investor Share Class is 1.41% (2.41% for Class C). Effective November 1, 2017 the Adviser has contractually agreed to waive Services Agreement fees by 0.24% of its average daily net assets through October 31, 2018. The Services Agreement fee waiver will automatically terminate on October 31, 2018 unless it is renewed by the Adviser. The Adviser may not terminate the fee waiver before October 31, 2018. The total expense ratio excluding the Services Agreement fee waiver for the Investor Share Class is 1.65% (2.65% for Class C).

The risks associated with the Fund, detailed in the Prospectus, include the risks of investing in small and medium sized companies and foreign securities which may result in additional risks such as the possibility of greater price volatility and reduced liquidity, different financial and accounting standards, fluctuations in currency exchange rates, and political, diplomatic and economic conditions as well as regulatory requirements in foreign countries. There also may be risks associated with the Fund’s investments in exchange traded funds, real estate investment trusts (“REITs”), significant investment in a specific sector, and nondiversification. Technology companies held in the Fund are subject to rapid industry changes and the risk of obsolescence. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund.

Distributed by Rafferty Capital Markets, LLC-Garden City, NY 11530.

Comments are closed.