“In tangled wreaths, in clustered gleaming stars,

In floating, curling sprays,

The golden flower comes shining through the woods

These February days”

Yellow Jessamine, by Constance Fenimore Woolson, 1900

The calendar tells us that the Spring Equinox occurred today, Monday March 20, 2017 at precisely 6:28 a.m. While seasons change at known dates, market cycles do not and there is no calendar marking upcoming changes in market sentiments.

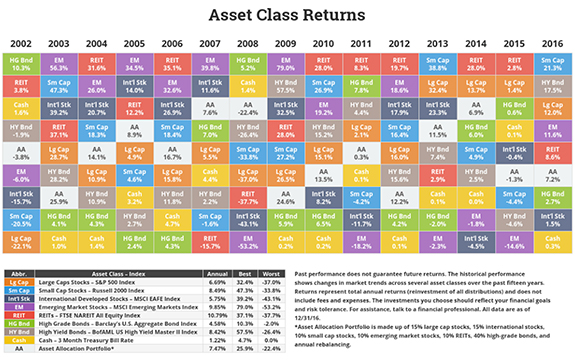

Weekend gardeners and professional horticulturalists know that adding a variety of plants to a garden can provide you with colorful blooms throughout all four seasons. During any one season, some plants may fade into the background just as a neighboring plant explodes in bright colors. For example, as the azalea loses its colorful flowers in the Fall, the chrysanthemum is just beginning to bloom orange, purple and yellow flowers. Gardeners who have diversified their plantings know that with a change of seasons the bright flowers of one plant will fade and it will be another plants time to shine.

Consider, for example, the Yellow Jessamine, the state flower of South Carolina. South Carolinians often train this hardy vine to grow-up a trellis or mailbox post. Drive down a road in South Carolina from May to November and you may not notice the Yellow Jessamine as it is a simple and nondescript ground cover growing over fence rows. But as early as December — the “dead of Winter”– the Yellow Jessamine produces a sweetly-scented yellow flower that seems to cover the entire roadside.

The Financial Advisors we partner with use the Castle Focus Fund (MOATX) for a variety of reasons. A regular theme we hear among the Advisors who have adopted our strategy is that they use the Fund as a means of reducing downside volatility in client portfolios. While we do not subscribe to Modern Portfolio Theory, we can relay that the Fund’s 5-year Beta is 0.53.1 Of course, that means that during frothy bull markets and market melt-ups we may participate sensibly but will also likely fade into the background versus our ‘full bloom’ peers.

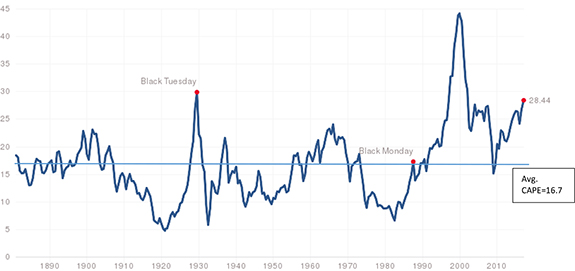

As students of the market, we know that the cycles of the stock market (optimism, euphoria, hope, despair) do not arrive on a regular timely schedule like the change of seasons (Spring, Summer, Fall, Winter). So when a long-lived euphoric bull market persists despite extremely rich valuations and fundamental economic challenges, we become more cautious. The Cyclically-Adjusted Price/Earnings ratio (The Cape), for example, now stands at a level well above its long-term average. While a high CAPE ratio is not necessarily predictive of a change of season for the stock market, it does give us caution as we believe that entry price on any investment is a key determinant of total return.

We know that clients who are enjoying the strong returns of what seems like a never-ending Spring may ask why they own such a Fund. We care deeply about your client’s hard-earned capital. We know that if markets drop, your clients will not care about relative returns or star ratings. They will care about losses. We want your valued clients to know that our goal is to compound shareholder capital over a full market cycle by participating sensibly when markets move up and striving to lose less when markets pull back. Our value-driven investment philosophy necessitates that we always be cautious and skeptical, but even more so when markets become euphoric and compelling investment opportunities become scarce.

When the South Carolina legislature named the Yellow Jessamine the State Flower in 1924 they remarked on the “constancy” of the plant, its hardiness and ability to bloom when all others had gone dormant. Right now the Castle Focus Fund may be a ‘boring’ part of client portfolios. But while our cautious approach to capital appreciation is currently in the background, we do serve an important purpose in thoughtfully and carefully-constructed portfolios: Our deep-value roots are there to guard against the erosion than can come when euphoria suddenly gives way to despair.

Kind Regards,

Caeli Andrews

Co-Founder, Managing Director

Castle Investment Management

Andrew Welle

Co-Founder, Managing Director

Castle Investment Management

The following indices, composites, averages and theories referenced in this commentary are defined as follows by Investopedia: The Standard & Poors 500 Index (S&P 500) is an index of 500 stocks. The Russell 2000 index is an index measuring the performance approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States. The EAFE Index is an index created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia. The MSCI Emerging Markets Index is an index created by Morgan Stanley Capital International (MSCI) designed to measure equity market performance in global emerging markets. The CAPE (the cyclically-adjusted price/earnings ratio) is a valuation measure, generally applied to broad equity indices, that uses real per-share earnings over a ten year period. Price-Earnings ratio (P/E Ratio) is the ratio for valuing a company that measures it current share price relative to its per-share earnings. Modern portfolio theory (MPT) is a theory on how risk-averse investors can construct portfolios to optimize or maximize expected return based on a given level of market risk, emphasizing that risk is an inherent part of higher reward.

The opinions expressed are those of the Fund’s Adviser and are not a recommendation for the purchase or sale of any security.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The Prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877-743-7820, or visiting www.castleim.com. Read it carefully before investing.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-743-7820.

The risks associated with the Fund, detailed in the Prospectus, include the risks of investing in small and medium sized companies and foreign securities which may result in additional risks such as the possibility of greater price volatility and reduced liquidity, different financial and accounting standards, fluctuations in currency exchange rates, and political, diplomatic and economic conditions as well as regulatory requirements in foreign countries. There also may be risks associated with the Fund’s investments in exchange traded funds, real estate investment trusts (“REITs”), significant investment in a specific sector, and nondiversification. Technology companies held in the Fund are subject to rapid industry changes and the risk of obsolescence. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund.

Distributed by Rafferty Capital Markets, LLC-Garden City, NY 11530.

Comments are closed.