Aim Small, Miss Small

In the movie The Patriot, Mel Gibson stars as a father trying desperately to keep his family untouched by the Revolutionary War taking place all around them in South Carolina. To his dismay, his eldest son, played by Heath Ledger, joins the Continental Army and is subsequently captured by the British. In an attempt to rescue his captured son, the father and two of his younger boys ambush the British captors. The young boys have never fired a gun at a person before and were concerned they might not be able to hit their targets. To help them focus on the task at hand, Gibson’s character instructs the boys to “aim small, miss small”. This advice, along with the boys’ shots, proved to be spot on.

Sometimes it is difficult to make sense of the big picture. Emotion, perception, and opinion can impair judgment. We know what we think, but that doesn’t always translate readily into how we should act.

As investors, we are bombarded daily by events or circumstances that could have a very real effect on our investments. We read about the markets on social media, or follow minute-to-minute on CNBC, Fox Business or Bloomberg. There are countless talking heads expressing opinions ranging from brilliant to boneheaded, but how are we to know which is which?

We worry about rising interest rates, inflation, Artificial Intelligence, China, Russia, the Federal Reserve, the next election, and so on. We may have strong opinions about some of these things. We may enjoy discussing, or even debating, these topics du jour. But are our opinions actionable? Should they be?

The point to be made here is that we are surrounded by noise. Having opinions about the noise is one thing, but having conviction is quite another. Investing based on opinion is no different than gambling. You wish for an outcome and hope it to be so. It is emotional. Emotional decisions are rarely our best decisions.

Some of the best minds on Wall Street make a living distilling all of this information down to a working investment thesis that they confidently share with investors. They make recommendations based on their world views. Interestingly, the same data often results in conflicting views among these ‘in the know’ types. How are we to know who is right? The person that got it right last time?

There is nothing wrong with investing based on the big picture. But you better get it right. If your view is that the market will fall and you invest based on that premise, being wrong could be very costly. Many professionals invest this way successfully. Many don’t. Placing a few large bets based on big picture things requires that you be right far more often than you are wrong, because the cost of being wrong is dear. If you implement your macro-themed investment strategy by selecting those sectors of the economy you believe to be the potential winners, there are only eleven sectors to choose among. If your strategy is to determine large companies vs. medium companies vs. small companies, there are only three choices. If your strategy is to decide between growth and value, there are only two.

We believe this type of approach can take on unnecessary risk. We don’t mean to criticize those that invest this way. We simply have a very different approach. We would prefer to make a lot of smaller investments rather than a few large ones. The Castle Tandem Fund owns 37 equity positions as of June 30, 2023.

To us, all the headlines and topics of conversation are simply noise – white noise to be tuned out. Big picture topics are great, but it is hard to make investment decisions based on them. We like to say that it is easier to have conviction about a company than an economy. Artificial Intelligence or the next election cycle may be topical, but they have very little to do with how much SPAM® Hormel (a Castle Tandem Fund holding) will sell next year.

You may recall the story of the Fox and the Hedgehog from our July 2020 commentary. The hedgehog is Tandem’s corporate mascot. He and the fox regularly do battle. The clever fox schemes up countless ways to prevail against his nemesis, only to fail each time. You see, the fox knows many tricks, while the hedgehog only knows one. But it is a really good one! He simply rolls up into a spiky ball until the fox gives up and goes away.

Like the hedgehog, we only know one trick, but we think it is a very big trick. We believe that it is our job to limit volatility in the Castle Tandem Fund while practicing the discipline of buying low and selling high. Yes, this may seem like obvious common sense, but it is rarely practiced. Many investors instinctively buy something anytime they sell something, or vice versa. The compulsion to stay fully invested at all times makes little sense to us, but it is common practice in our industry.

As an aside, why is it that we seem to understand that there are buyers’ markets and sellers’ markets in real estate, but not in stocks? The best times to buy and the best times to sell rarely coexist. Stocks have an advantage over real estate when it comes to incremental selling and buying. In a sellers’ market in real estate, you must sell the entire property. You can’t just sell the kitchen and dining room. But in stocks, if we own 100 shares of a company that we like but think is too expensive, we can sell 25 shares and keep 75 shares. It doesn’t have to be all or nothing.

Now back to our hedgehog concept. In our view, volatility is the enemy of every investor, professional and individual alike. Volatility makes many investors want to behave emotionally. They see the market going higher, they perceive there to be less risk, they are afraid of missing out on a great opportunity, and so they buy – high. On the flip side, they see the market going lower, they get scared, they perceive risk to be rising, and want out, so they sell – low.

Our desire to limit volatility through the discipline of buying low and selling high is our core reason for being. Hopefully, it keeps investors invested. If you are invested in equities, we presume it is because you need growth to achieve your financial goals. Because of the average investor’s tendency to behave emotionally and buy high and sell low, few investors actually achieve the same returns as the investments they select. They meddle. They buy too high, sell too low, and as a result, the average investor routinely underperforms the market. If our approach can help keep you invested, that is a win.

Reducing volatility begins with investment selection. Economies can be very volatile, but not every company is. We try to identify businesses that have grown through any economic environment, including a financial crisis, a global pandemic, and whatever it is that we are in right now. Businesses with a track record of growth through all of these difficult environments have a tendency to produce more consistent, repeatable, less volatile experiences for their shareholders. If we can identify these companies, we believe we can limit the overall volatility in the Fund.

Specifically, we value growth in terms of earnings, revenue, and cash flow. These rates of growth are easily knowable. If we own a business that no longer grows these metrics, we can’t own it anymore. We must part ways. For those businesses that do meet our criteria, we rely on a simple mathematical process called mean reversion to try to buy low and sell high. In statistics, we learn that most populations, experiences, or in the case of stocks, valuations, fall within a fairly well defined pattern of distribution. That means that most of the time stocks are fairly priced. But not always.

When a valuation falls outside of this range, statistics informs us that there is a very high probability that this valuation is unsustainable and will likely revert back to the mean, or fair value. So if we own a company that meets our criteria but has become unsustainably overvalued, we will sell a fraction of our holdings. Similarly, if we own a company that meets our criteria but is unsustainably undervalued, we will add to our holdings. And if we don’t own it, we will buy.

And this is how we try to limit volatility through buying low and selling high. It seems like common sense to us, but it is so rarely practiced. Identify companies with track records of consistent growth through any economic environment, rely upon the simple statistical principle of mean reversion to buy, hold, or reduce, and get rid of any company that ceases to grow. Hopefully this produces a consistent repeatable experience that can help keep investors invested. Aim small, miss small.

Market Commentary

A tale of two markets

The first half of 2023 is officially in the books, and what a remarkable start to the year it has been. The Nasdaq experienced its best start to the year since the early 80s, surging over 32% in the first 6 months of 2023. The S&P 500’s move felt a little muted compared to the Nasdaq’s blistering pace, though it too was up more than 16%. Despite the large moves in major indices, it really has been a tale of two markets.

The impressive return year-to-date has been spurred on by just a few names and underlying trends. Technology and AI-related stocks have experienced quite a boom, while the rest of the market has been left behind. This year’s market leaders, dubbed “The Magnificent Seven” (which consists of Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla), account for more than 80% of the Nasdaq Composite’s total gain in market cap through the first 6 months.

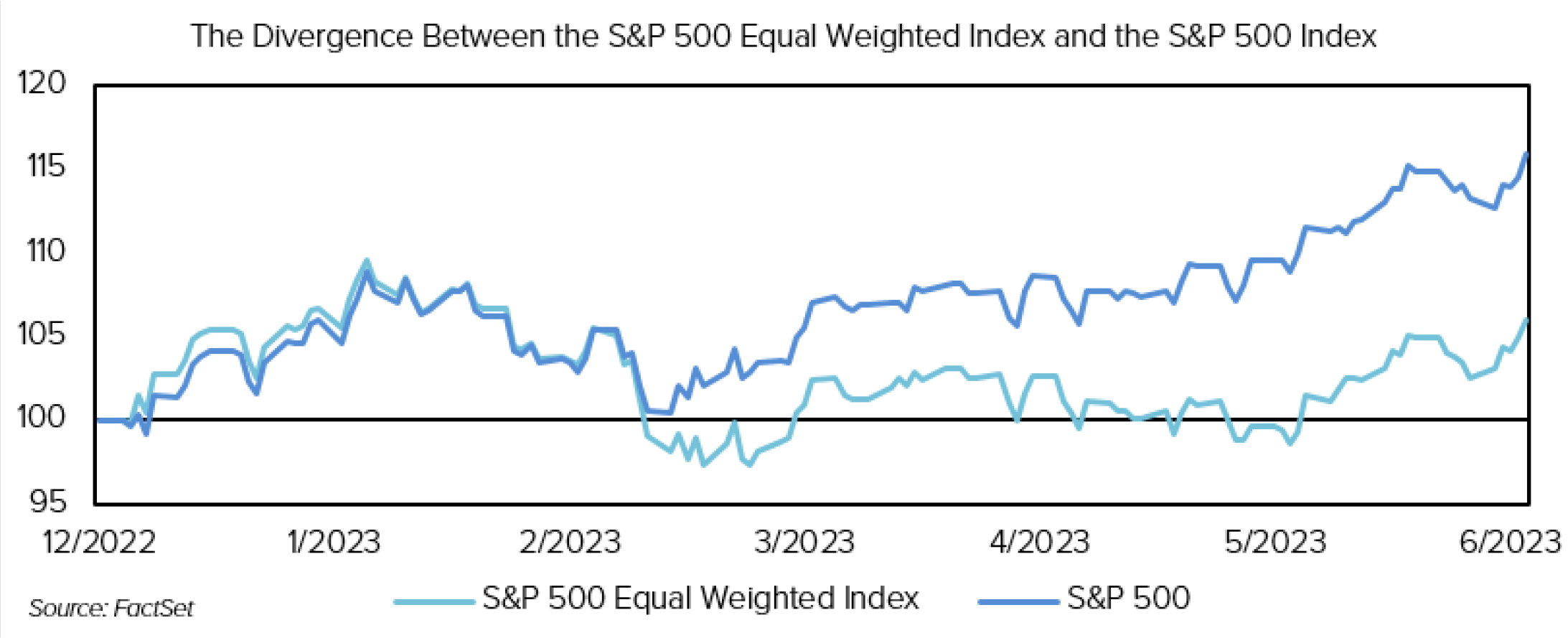

So, if one were to look only at the headline numbers, they would see a tech-centric market that was up 30+% and a broader average that was up more than 16%. Not a bad start to the year according to those numbers. Except it doesn’t tell the full story. The average stock is having a much tougher year than the members of the Magnificent Seven. The S&P 500 equal weighted index, which can be a better indicator for the “average” stock, was up less than 6% in the first half.

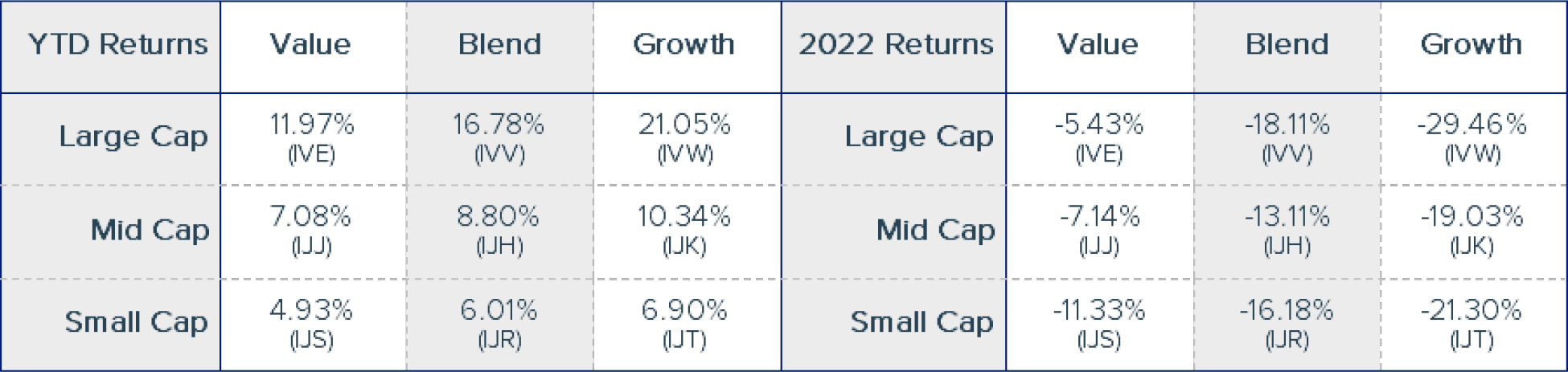

The disparity in returns is even more obvious when looking at a style box. Growth has performed better than value, and larger stocks have performed better than smaller stocks. Last year was nearly the exact opposite. The size of the company was less important, but the tilt between growth versus value was vital for investors. 2022 punished growth stocks as interest rates soared. This year’s market has been more like the post-COVID market that was hyper-focused on growth related names.

Stocks have also received a helping hand from the cooling of inflation. The price of goods has continued to rise, but the rise is at a slower and slower pace. This in turn has led to a hope for investors that the cooldown in inflation would be met with a relenting Federal Reserve. The Fed, which has had two feet on the brakes for the better part of 15 months as they raised interest rates again and again, is finally showing signs of easing up. Between the less hawkish Federal Reserve and the slowdown in inflation, longer-dated interest rates have largely stopped rising. According to FactSet, the 10-year U.S. Treasury was yielding 3.88% at the end of 2022. At the end of June, the yield was 3.81%. Generally, as yields fall, large cap growth stocks will benefit. This year, large cap growth stocks haven’t even needed yields to fall. They’ve just needed a break in the non-stop rise that was 2022.

Looking forward, it would seem that we are reaching an inflection point of sorts where one of two outcomes seem most likely. The “average” stock could begin to participate more to the upside, closing the gap between the rest of the market and the Magnificent Seven. This would be ideal and more indicative of a healthy bull market. Or, the Magnificent Seven could catch up to the rest of the market by means of retreating. This would likely lead to a more volatile market than that which we saw in the second quarter. The answer will likely depend on the direction of the economy – specifically the labor market. The market has traded like there will be no recession. However, there have been a few companies and a few trends that have indicated that not all is well under the hood. Ultimately, only time will tell the direction in which we are headed.

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The Standard & Poors 500 Index (S&P 500®) is an index of 500 stocks. The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance.

As of June 30, 2023 the Castle Tandem Fund held the following positions mentioned in this report: Hormel Foods Corp (HRL, 2.25% of Fund total net assets) and Microsoft Corp. (MSFT, 2.32% of Fund total net assets). The Fund does not have a position in Meta, Apple, Amazon, Alphabet, Nvidia or Tesla.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877-743-7820 or visiting www.castleim.com. Read it carefully before investing.

Important Risk Information

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Distributed by Arbor Court Capital, LLC – Member FINRA / SIPC

Comments are closed.