Looking backward to move forward

For most investors, 2022 was a challenging year. The struggle to regain some sense of normalcy following a global pandemic took a new twist. Volatility stood the market on its head in 2022. Stock prices fell, interest rates rose, bond prices fell, and according to Callan’s Periodic Table of Investment Returns cash was the only traditional asset class that provided a positive rate of return for the year. Most non-traditional assets fared poorly too. Despite an overwhelming desire for it, normalcy may take longer to find than we wish.

The rise in stock prices from the depths of the pandemic-induced decline were as impressive as we have seen in some time. The S&P 500 advanced nearly 120% from low to high. That’s not normal, yet few complained in the moment. The market’s decline from its high has been far less dramatic, yet it has been accompanied by much hand wringing. I have heard countless complaints about stock market volatility in 2022. Let’s have some perspective.

It is true that the S&P 500 was down 18.11% for 2022. However, despite last year’s decline, the 3-year annualized rate of return for the S&P 500 as of 12/31/22 is 7.66%, the 5-year annualized return is 9.42%, and the 10-year annualized return is an eye-popping 12.56%. These rates of return remain near or above historical norms, but they are approaching normalcy. By comparison, at the end of 2021, the 3-, 5-, and 10-year annualized returns were 26.07%, 18.47%, and 16.55% respectively. These returns were far from normal.

As “The Head Ball Coach” Steve Spurrier once said, “hindsight is 50-50”. With the benefit of that hindsight, it’s easy to say now that the rates of return the market had been producing were unsustainable. But in the moment, few had the audacity to openly discuss the inherent risk in stock valuations. We did. And not only did we discuss the risk, but we also reduced our exposure to it.

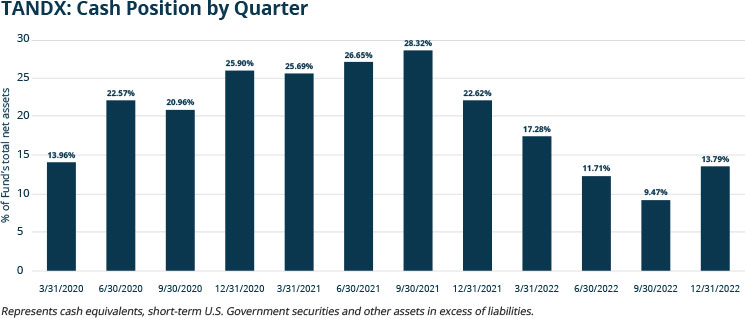

In the fall of 2021, the S&P 500 was near all-time highs, interest rates were near zero, inflation was only a rumor, and the Federal Reserve hadn’t raised rates since 2018. All seemed right in the world for investors, and risk was widely viewed to be minimal. And the Castle Tandem Fund had unusually high levels of cash as the market was setting new records. Why? Because we strive to practice the discipline of buying low and selling high. In 2021, by following our investment methodology, we simply had more stocks to sell than buy. We were not making a market call. Our investment discipline simply identified more companies to sell than to buy, so cash levels rose. Our process was leading us to reduce risk in individual stock positions as the market was near an all-time high.

By year-end 2022, the S&P was well below its all-time high, interest rates were higher than they had been in more than a decade, inflation had set a record, and the Federal Reserve raised rates 7 times, taking the Fed Funds target rate from 0.00% – 0.25% all the way to 4.25% – 4.50%. This marked one of the steepest rate hikes in history, and the world was recognizing a very different reality. The amount of cash in the Fund declined significantly, even though most perceived risk to be greater. Why? Opportunity was abundant and we were able to put capital to work at valuations that were finally compelling. We were buying low. We had more to buy than to sell, and cash levels declined.

Too often, investors fall victim to recency bias. If something is working, the belief is that it will continue to work. Similarly, if something isn’t working it must be abandoned. We believe in looking backward to move forward. But in looking backward, we must look further back to gain a fuller understanding of what is possible.

A common mistake among investors is to assume that investment performance last year is likely to be replicated again this year. This “buy the winner” mentality is understandable, but stock price performance is not, in our view, what we should be observing. Companies cannot control their stock price performance in the short run. Some can, however, control the things that lead to business success. When this occurs, stock price appreciation is more likely to follow in a consistent, sustained manner.

Our discipline is designed to reduce risk by reducing volatility – we strive to deliver a consistent, repeatable experience. We believe that volatility is the enemy of most investors because it tempts us to do the wrong thing at the wrong time. When we see the market going ever higher, we want in, and we risk buying high. When we see the market going lower, the temptation is to assume that risk is rising and to get out. This can lead to selling low. Buying high and selling low is not a winning formula.

In order to reduce the volatility of the portfolio, we must reduce volatile components within the portfolio. We attempt to identify businesses with a sustained history of growth, through any economic environment. Businesses that are better able to control their own destiny are more likely to be less volatile.

Growth through any economic environment is a tall order, and not many companies can meet this demanding criteria. In fact, many companies that are often called blue chips fail to meet our criteria, and are therefore not included in the Fund. A sampling of such companies that we exclude is:

|

|

|

|

|

|

|

|

|

|

|

|

The companies that the Fund owns have demonstrated the ability to grow earnings, revenue, and cash flow consistently over time, regardless of the economic environment. Every holding in the Fund is required to pay, and grow, a dividend.

I sincerely hope that the Castle Tandem Fund continues to meet your expectations. We strive to deliver a more consistent, repeatable, less volatile experience. In times of uncertainty, consistency can provide comfort. Yet in a chaotic world, consistency can prove elusive.

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The Standard & Poors 500 Index (S&P 500) is an index of 500 stocks.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877-743-7820 or visiting www.castleim.com. Read it carefully before investing.

Important Risk Information

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Distributed by Arbor Court Capital, LLC – Member FINRA / SIPC

Comments are closed.