Financial Markets Review

The recovery in equity prices that began in mid-June started to retreat in August. All three major indices – the S&P 500, Nasdaq, and Russell 2000 – made a closing low on June 16th and topped out around the middle of August after advances of 17.4%, 23.3% and 22.5%, respectively. Since then, each index has given back roughly half of its summer rally. Meanwhile, short-term Treasury yields continue to march higher, as the 3-month Treasury bill approaches 3% and the 2-year Treasury note has eclipsed 3.5%. To put these yields into perspective, one year ago, these securities yielded 0.05% and 0.20%, respectively.

Depending on the day and who you talk to, U.S. equity markets are still in a bear market or have begun a new bull market; the economy has reached peak inflation, and thus, peak Fed, or the economy has entered a period of high sustained inflation, which begets a “higher for longer” Fed; corporate earnings continue to show resiliency or analysts remain behind the curve in forecasting deteriorating fundamentals. There has been a lot for one to digest and the narrative literally changes day by day or even hour by hour.

The constant back and forth between good data, bad data, the Fed does this or that, has led the financial media to tirelessly discuss only one thing – whether or not the Fed hikes 50 or 75 basis points at the next FOMC meeting. I hate to burst the bubble of anyone that finds this debate to be truly intriguing, but it doesn’t matter. In the grand scheme of things, the difference between a 50 and 75 basis point rate hike is negligible.

You would be better served stepping back from the daily banter and looking at the bigger picture.

The trends that have been in place for the past couple of months have not changed. Broadly speaking, U.S. and global economic data is slowing, expected corporate earnings growth is decelerating, short-term interest rates are moving higher, and valuations are elevated on a historical basis. Most importantly, the Fed remains steadfast in their quest to bring down inflation.

Fed Chair Powell could not have been any clearer in his short, to the point speech delivered at the Fed’s annual meeting in Jackson Hole a couple of weeks ago.

“Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.

We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.”

– Fed Chair Powell, August 26, 2022

In so many words, the Federal Reserve is comfortable with leading the economy into a recession if that is what will choke off inflation. Many economic data points are trending in that direction, while the Treasury curve has, more or less, declared a recession to be inevitable. What this all means is that financial markets will continue to be volatile for the foreseeable future, and the market environment we’ve been in since the end of last year is likely to continue. There will be opportunities to buy and sell individual stocks along the way, but by no means are we out of the woods. It is important to use the day-to-day gyrations and uncertainty of others to your advantage, but ultimately not to lose the forest for the trees.

Castle Tandem Fund Update

For months, if not years now, we have been pretty consistent in our messaging that volatility breeds opportunity. Most people only associate volatility with falling equity prices. In reality, volatility is very much present when equity prices rise. Bear markets are synonymous with heightened volatility and famous for some of the largest price swings, both up and down. Therefore, it is imperative that an active manager be just that, active, and take advantage of the volatility inherent in a bear market.

There will be times when the risk/reward is in your favor and the opportunity is to put cash to work. It is well documented how aggressive we were in buying new positions or adding to existing holdings from January through mid-March and again from early May to mid-June. Our cash position decreased dramatically over these times, as our quantitative model signaled more opportunities to buy than to sell.

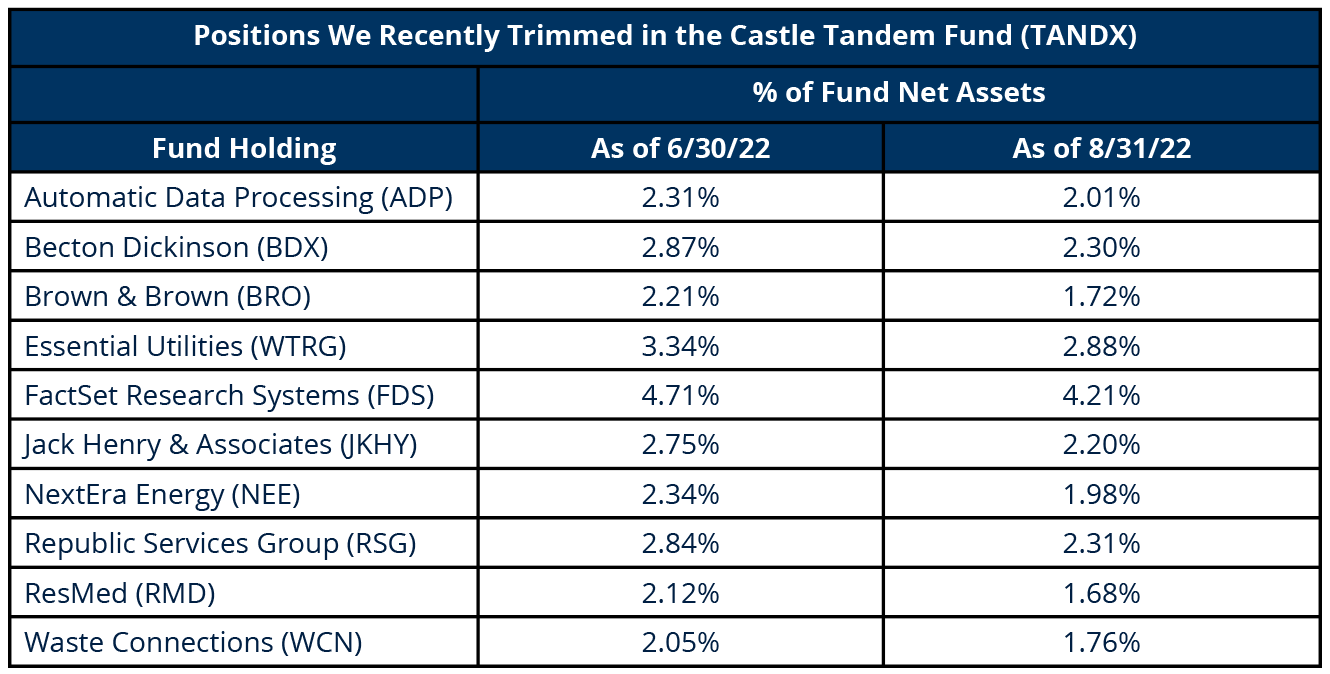

Then there are other times where the risk/reward is not in your favor and the opportunity is to pare back some of your positions. This happened earlier this year around the first few weeks of April and again over the most recent six or so weeks. As equity markets recovered from their 2022 lows in June, many stocks experienced a much more robust rally than the 17.5% bounce in the S&P 500. The rapid recovery in select individual stock prices was one factor that caused our quantitative model to shift us from being net buyers in mid-June to net sellers into early August. We have listed the positions we partially sold within the Castle Tandem Fund during that time.

The sales made over the past several weeks have been valuation sales as opposed to fundamental sales. With a valuation sale, we pare back our position when our quantitative model gives us a sell signal, indicating the stock’s current valuation is unsustainably overvalued given its growth and fundamental characteristics. We still believe in the company, as it continues to meet all of our fundamental criteria; however, the risk/reward is not in our favor from a valuation perspective, so we take a little bit “off the table”. And now that cash has risen a little bit — from 11.71% on 6/30/22 to 16.92% on 8/31/22 — we can once again be patient in deploying that cash should equity prices correct and opportunities emerge. As the recent volatility continues to build and we enter an historically seasonably weak time for the equity market, the opportunity to be net-buyers once again doesn’t appear to be too far away.

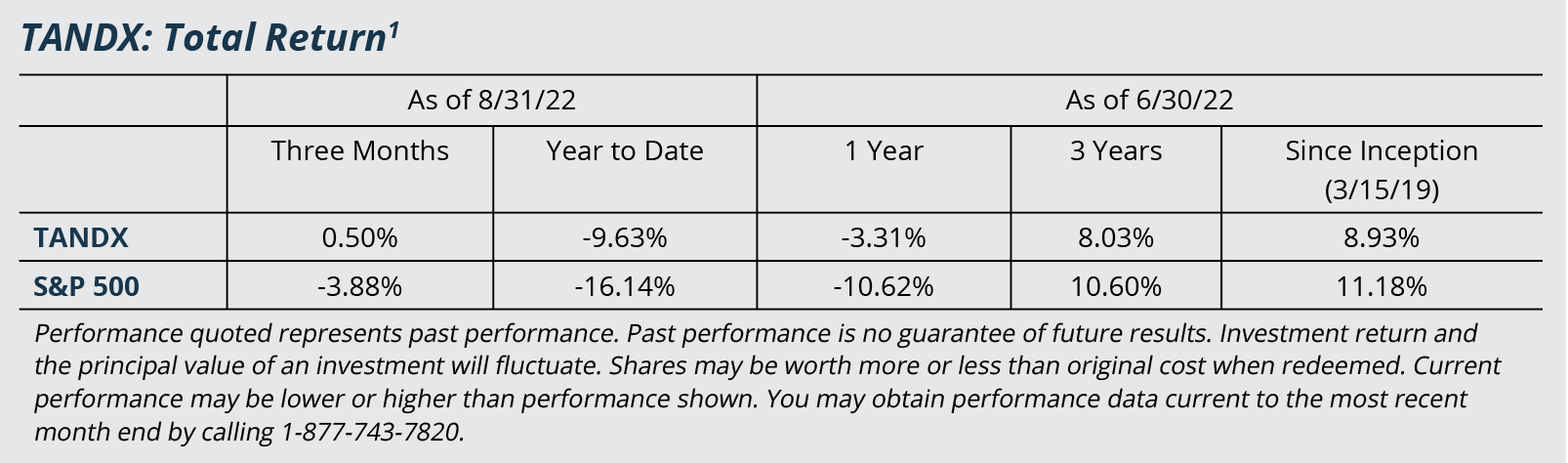

1 The gross expense ratio for the Institutional Share Class is 1.60%. The net expense ratio for the Institutional Share Class is 1.20%. Effective November 1, 2021 the Adviser has contractually agreed to waive Services Agreement fees by 0.40% of its average daily net assets through October 31, 2022. The Services Agreement fee waiver will automatically terminate on October 31, 2022 unless it is renewed by the Adviser. The Adviser may not terminate the fee waiver before October 31, 2022. The waiver may be terminated by the Board of Trustees.

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The Standard & Poors 500 Index (S&P 500) is an index of 500 stocks. The Nasdaq Composite Index is a market-cap weighted index of more than 2,500 companies listed on the Nasdaq stock exchange. The Russell 2000 index measures the performance of the small-cap segment of the US equity universe.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877-743-7820 or visiting www.castleim.com. Read it carefully before investing.

Important Risk Information

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Distributed by Arbor Court Capital, LLC – Member FINRA / SIPC

Comments are closed.