Market Commentary

Forget the Old Valuation Metrics. Price/Stimulus is in the Driver’s Seat Now

October 26, 2020

If you thought that stock prices were driven by economic growth, think again! In spite of a global pandemic responsible for shutting down countless businesses and putting entire industries in peril, the S&P 500 hit another all-time high as recently as September 2nd. This market is clearly focusing on the expectation of a prosperous and healthy future without getting distracted by the chaos and confusion of the present.

Markets are supposed to be forward looking, discounting the past and the present, while valuing what lies ahead. But is that what is really at play here? Or are other factors propelling this market to new heights? It is impossible to know in the moment, but we can certainly speculate!

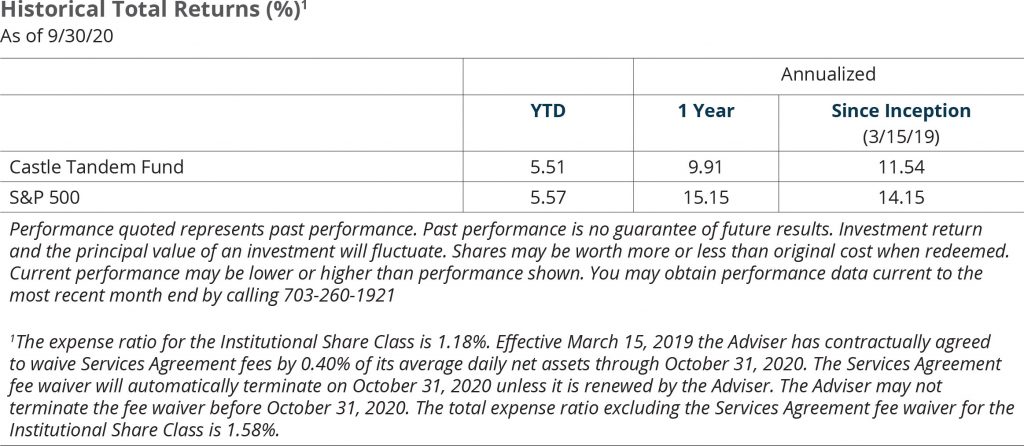

First we shall put forth the facts. September was a down month for the market, following 5 consecutive months of advances. For the 3rd quarter, despite its September decline of 3.80%, the S&P 500 Total Return Index managed a gain of 8.93%. That is a pretty strong advance, and it put the S&P up 5.57% year-to-date. Below the market’s surface, growth continued its significant outperformance relative to value, advancing 11.4% vs. 3.9%. Growth has really been on a tear, while value has struggled to find its footing.

It would be logical to conclude, with performance like this, that the economy must really be humming along. And in fact it is, at least by certain measures. The problem is that many of those measures don’t capture the entirety of the economy. Small businesses struggling to survive are not part of the S&P 500. Many Mom & Pop stores and restaurants are having their existences threatened in the COVID economy, while big box retailers and those businesses with a strong virtual presence are thriving. Big and small, in many instances, are on divergent paths.

And so the market moves higher as big public companies emerge as clear winners. Some market observers question how sustainable such a market advance can be. Eventually the have-nots will weigh on the haves, or so the theory goes.

We would argue that this is already occurring, and that it doesn’t seem to matter. At least not yet. In the table below we illustrate earnings expectations for the S&P 500 in 2020 over time. The table begins 1 year ago, when earnings for 2020 were expected to be $180.06. In the following 5 quarters, expectations have declined to $113.84. That is a 36.78% decline in earnings expectations. Surely the market is down, right?

In fact, the closing price of the S&P 500 is up 12.98% while earnings expectations are down nearly 37%. Reasonable people may wonder how this can be. How is the market so divorced from economic reality? The market has a massive tailwind at its back. Monetary (Federal Reserve) and fiscal (Congress) stimulus in response to the coronavirus pandemic are estimated by Bank of America to have exceeded $20 Trillion (yes, with a T). Apparently $20 Trillion in stimulus can cure a lot of economic ills!

One result of all this largesse is that earnings matter less than they once did. Fiscal and monetary policy are what we must divine now, not just profits. As long as there is more stimulus on the way, and as long as the Fed holds rates low, this party can last longer than it should. At the end of September, the 10-year US Treasury offered an interest rate of 1.86%. Over the last 50 years the average yield for the 10-year has been 6.33% and it has been as high as 15.32%. It has rarely been lower.

With rates so low and Treasury and Fed balance sheets expanding, there is little alternative to the stock market. Where else are you going to put your money today? But how many would jump at the chance to get just the average yield of 6.33%, much less the high of 15.32%? If rates ever do go higher, stock investors should be wary. Right now, that seems like a needless worry.

Commentary

Sexton: I think the whole world’s gone mad.

Death: Uh-uh. It’s always like this. You probably just don’t get out enough.

Neil Gaiman

Most Americans now get their news from social media, which is probably not the best straight news source. For the few of us left that don’t, we most likely consume news from sources that speak to our own points of view. To that end, how many of you Republicans reading this rush to learn Rachel Maddow’s perspective on the President’s Middle East peace initiatives? And how many of you Democrats find informative Laura Ingraham’s take on the House’s latest attempts to pass some form of COVID-19 relief? Most of us would rather see the world through a comfortable lens, rarely attempting to gain the perspective of a different point of view.

The tragic part of this information isolation is that we fail to even recognize the other half of our population. Red and blue rarely co-exist. And thus we seem helplessly divided, with one side right and one side wrong. You decide which side is which.

The point of all this is to say that none of this is new. It is just easier than ever before to limit the perspectives we consume, and easier than ever before to criticize those with whom we disagree. But this division is not new, and our country is no more divided now than in the past.

We are simply victims of recency bias. Things happening now seem bigger, more important and more consequential than those things that happened in the past. Our memories often lose perspective. But this is not new.

Reader: What is this diatribe all about? I thought this was supposed to be commentary relevant to investing!

Tandem: We get questions about this from investors. They are rightly concerned about current events and how they may impact the market!

Reader: Well then talk about that.

Tandem: OK!

We regularly hear from investors that they are concerned about the election. Some fear that a Biden victory will hurt the market with higher taxes and more regulation. Others just fear four more years of Trump. And these investors want to know how we are positioning the Castle Tandem Fund for the potential chaos ahead.

Many are concerned that the market has lost any connection to the economy and can’t figure out why prices continue to rise when so many are unemployed and we have no cure for COVID-19. They don’t believe the market is accurately reflecting our present circumstances and want to know how the Castle Tandem Fund will fare.

These concerns are quite valid. There are many other things to be concerned with as well, and we won’t even mention them in case you haven’t thought of them yet! Again, this is not new.

It has long been said that the market climbs a wall of worry. That means that in spite of all the reasons we can think of that stocks shouldn’t rise, they still do. Many wring their hands over the market’s lofty valuation and say this cannot last. Yet the market continues higher.

Until it doesn’t. And guessing when that switch might get flipped is pure folly. No one can successfully time the market. Instead of trying to figure out when they should get in and when they should get out, investors would be better served if they did not succumb to this false binary choice.

Reader: What the heck are you talking about? What is a binary choice?

Tandem: As you undoubtedly are aware, binary simply means there can only be two outcomes. Either good or bad, either blue or red, either up or down. The problem is that the world is far more gray than it is black and white. And so when we think we can only experience one or the other, we invariably experience some degree of both.

Reader: So how do you propose we avoid succumbing to this binary choice?

Tandem: Excellent question! Now we are getting somewhere. We will try to explain.

Instead of thinking in terms of in or out of the market, investors are better served when they think in terms of degrees of risk. If the investor thinks the market is due for a major sell-off, the temptation to get out of the market should be avoided. If the market fails to meet the investor’s expectation, getting back into the market can prove very problematic.

Similarly, if an investor believes the market is poised to go higher, the temptation is to invest more aggressively. If a dramatic move to the upside fails to materialize, the investor has bought high and is exposed to greater risk to the downside.

Thinking in terms of degrees, rather than all or nothing, would have served these two investors far better. Think about the volatility of the S&P 500 over the last three years – it is pretty extraordinary. In the first quarter of 2018, the market saw a sharp spike higher, immediately followed by a roughly 10% decline. The market recovered to another high in the third quarter, only to fall nearly 20% in the fourth. 2019 was a fairly straight ride higher, to a peak in February of this year. And then came COVID with a bear market sell-off, followed by a nearly 60% recovery.

The last 3 years have produced a wild ride that whipsawed many investors. Those pursuing an all or nothing strategy most likely bought stocks when prices were high and rising, and sold them in the steep declines. They were buying high and selling low.

Doing nothing would have netted better results, but likely more anxiety as well. We believe the middle road is the best road. Minimizing the peaks and troughs can reduce anxiety and help fight the very human urges to buy when prices are high and sell when prices are low.

From Tandem’s perspective, “the market” is not an investment. It is a measuring stick that we may want to compare ourselves to over time, but we do not seek to behave like “the market”. We do not invest your money for the sake of being invested. You invest in the Castle Tandem Fund with the expectation that we will deploy your capital prudently and wisely. What we pay for securities matters a great deal.

The Castle Tandem Fund is a collection of individual companies, each of which has met a set of criteria that makes it, in our view, worth owning. These companies are added to the portfolio independently of one another. When we buy a security, we buy it because it meets our criteria and we can pay a price we think is reasonable to pay. When we eliminate a company from the Fund, we do so because it no longer meets our criteria. And when we take profit in a company, we do so because it meets our criteria and we want to keep it, but its valuation is too expensive and we wish to take some money off the table.

Reader: So what are these criteria of yours?

Tandem: We demand that any company in the Fund grows through any economic environment. Growth is knowable, quantifiable and not subject to interpretation or emotion. It is either present or it is not. We measure growth in terms of earnings, revenue and cash flow, and because these things are present, the dividend must also grow. Simple as that.

Reader: How do these criteria help you think differently than the rest of us?

Tandem: We aren’t suggesting we think differently. Our discipline, based on these criteria, allows us to behave differently. We will try to explain.

Tandem will only hold those securities that meet our criteria. When they are inexpensive we will add to them, and when they are expensive we will scale back. When they cease to meet our criteria, we liquidate them. We take very seriously the notion of buying low and selling high, and having the discipline and patience in between. Rarely do the best time to buy and the best time to sell co-exist. Most investors feel compelled to buy something whenever they sell something. We do not. That seems arbitrary and capricious to us.

We buy when valuation compels us to do so. We scale back when valuation seems to us to be unsustainably high. If there are more things to buy than sell, cash levels in the Fund will naturally decline as a by-product of our process. Cash levels do not decline because we decided “the market” was cheap. Cash levels decline because we found more things to buy than to sell, and our decisions are based solely on math, not emotion, bias or interpretation. It’s just math.

Cash levels rise when the reverse is the case—there are more things to sell than buy. But these buy and sell decisions are not based on a view of the market, or the economy, or the election, or the Federal Reserve. They are made in isolation, one company at a time, void of anything other than our math.

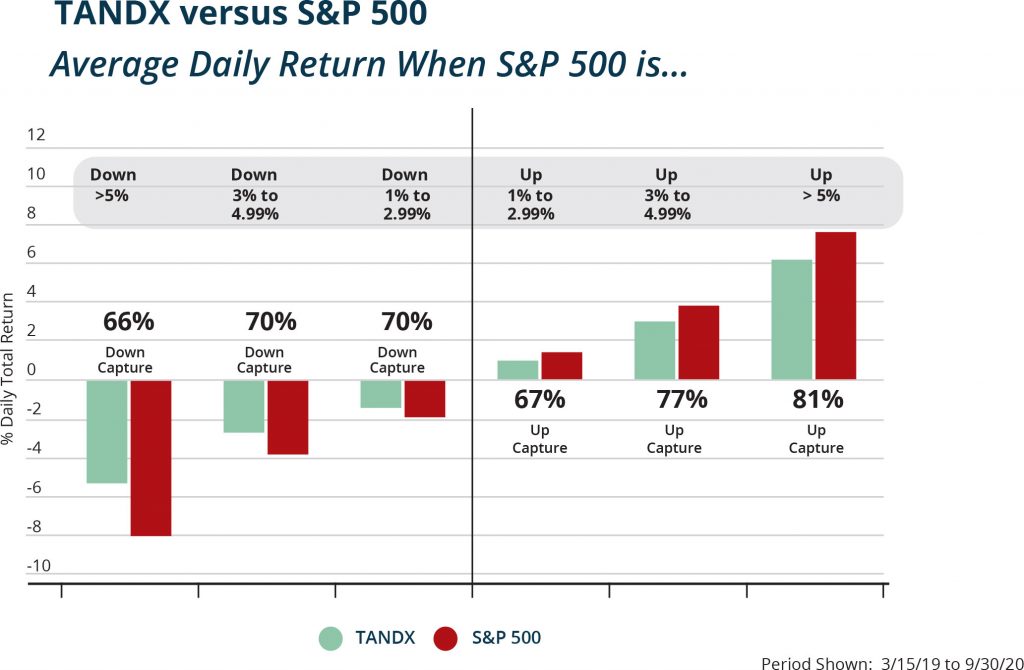

This is a time-tested investment discipline, meant to limit the market’s extremes (both good and bad) and instead deliver a much smoother, more consistent experience. We believe that volatility is the enemy of the average investor. It makes us all want to do the wrong thing at the wrong time for the wrong reason. By limiting volatility in the Fund, Tandem hopes to keep investors invested by controlling the risk within the portfolio. This middle ground of risk control avoids the in or out mentality. The chart below shows how the Fund has performed on days when the S&P 500 was either up or down more than 1%. As you’ll see, on days when the market was down steeply, the Fund tended to participate less. And on days when the market was up sharply, the Fund participated in a more muted fashion.

Tandem thinks in terms of degrees of risk, not whether to get into or out of the market. When we proactively sell when prices are high, we are reducing our exposure to overvalued securities. When we remove securities from our portfolios that no longer meet our criteria, we are reducing risk by eliminating fundamentally flawed companies. When the market corrects, or worse, overvalued and flawed companies typically perform worse than reasonably priced, fundamentally sound securities. We have reduced risk, not tried to time the market.

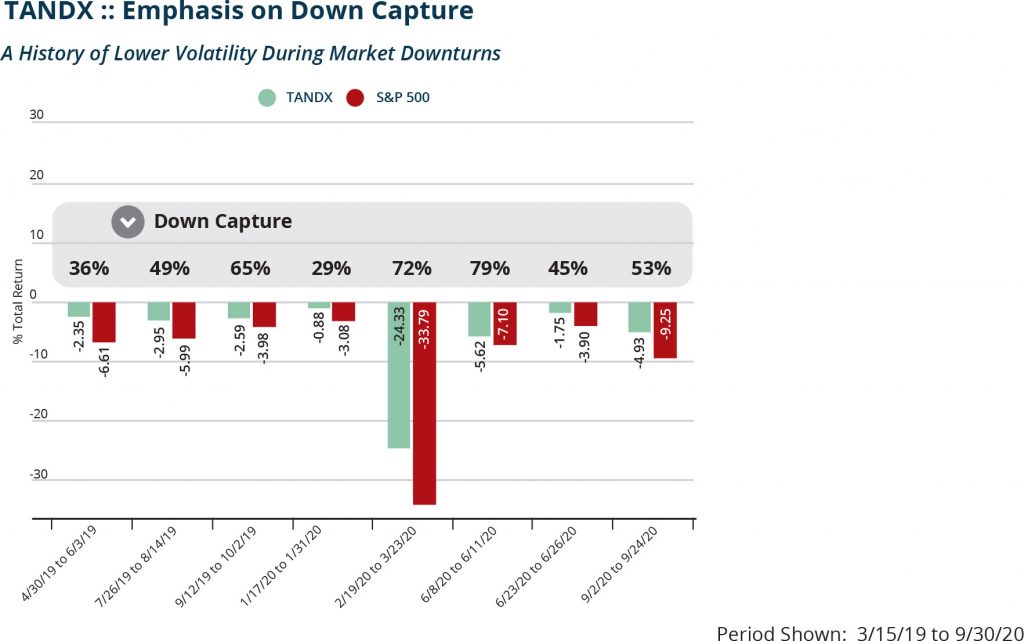

In the short run, the Fund is left open to the possibility of underperforming a market that is high and rising. That, to us, is the proper risk to take. We are still invested, and still exposed to the market’s direction. We are simply exposed to a lesser degree. When prices ultimately fall and valuations become compelling again, we have cash to put to work when others are selling. The next chart shows you how the Fund has participated less during periods where the S&P 500 has experienced negative returns.

Reader: Is Tandem a contrarian investor?

Tandem: Not really. We are a reversion-to-the-mean investor, which is to say we believe that identifying unsustainably cheap and unsustainably expensive securities produces a more consistent, less volatile experience for the investor.

Extreme positions are likely to be unsustainable. Whether considering how we consume news, how divided we are as a nation, what the election result might portend for the market or whether investors should be all in or all out, Tandem believes extremes are ultimately self-correcting. Avoiding binary outcomes, at least as an investor, produces less risk. Finding the middle ground helps us to avoid the extremes, and it keeps our clients invested through any economy, much like the companies we hold – businesses that grow through any economic environment.

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The up capture and down capture ratios are statistical measures of a manager’s overall performance in upward moving and downward moving markets, respectively.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877-743- 7820, or visiting www.castleim.com. Read it carefully before investing. Distributed by Rafferty Capital Markets, LLC Garden City, NY 11530.

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Comments are closed.