Q2 2020 Commentary: The Fox and the Hedgehog

July 27, 2020

The ancient Greek poet Archilochus wrote “the fox knows many things, but the hedgehog knows one big thing.” The fox has clever ways to ensnare the hedgehog. Each time, the little hedgehog rolls up into a prickly ball, creating an impenetrable defense to the fox’s nefarious efforts.

Philosopher Isaiah Berlin used this parable as the basis for the title of his essay The Hedgehog and the Fox, published in 1953. In this work, Berlin divides writers and thinkers into two groups – those possessed of a single defining idea (hedgehogs) and those influenced by multiple notions with room for nuance (foxes).

Noted business author Jim Collins later applied the concept to business in his book Good to Great. Collins developed the notion that organizations are more likely to succeed if they can identify the one thing that they do best – their “Hedgehog Concept.”

The story was also loosely adapted into a cartoon in the 1960s as The Road Runner Show. Any reader that watched Saturday morning cartoons no doubt recalls this interpretation of the parable. In the series, Wile E. Coyote devises elaborate schemes to capture the speedy Road Runner. Mr. Coyote’s business card even lists his title as Genius. While the many methods of entrapment he devises could be considered ingenious, they never manage to ensnare Road Runner, for Road Runner’s one big thing (his speed) is mightier than the many things Mr. Coyote employs.

Tandem is a hedgehog. Our one big thing is our desire (not our promise) to be the best in the world at providing market-like or better returns over a complete market cycle with a less volatile, more consistent experience for investors. We seek to reduce risk when the odds appear to be against us, and we seek to add to risk when the odds seem in our favor. We will leave it to those we serve to determine whether we have attained our goal. But it remains our primary motivator and our one big thing.

Our hope is that this approach limits the stock market’s impact on the shareholders of the Castle Tandem Fund during turbulent times, allowing them to stay invested through a market cycle. We believe that if we can achieve this, then shareholders have a better chance at investment success. As we wrote in our January Commentary, we believe that staying invested is the key to investment success, and we also believe that limiting volatility is the key to staying invested.

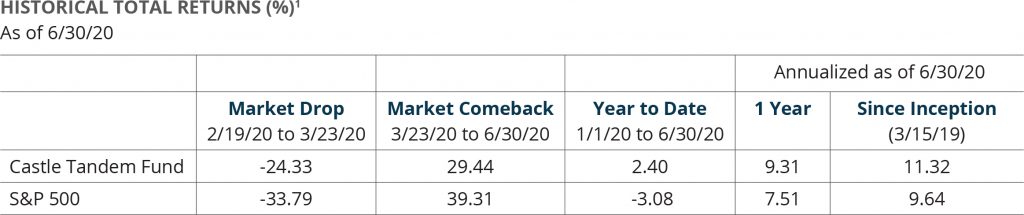

Performance quoted represents past performance. Past performance is no guarantee of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Current performance may be lower or higher than performance shown. You may obtain performance data current to the most recent month end by calling 703-260-1921.

1 The expense ratio for the Institutional Share Class is 1.18%. Effective March 15, 2019 the Adviser has contractually agreed to waive Services Agreement fees by 0.40% of its average daily net assets through October 31, 2020. The Services Agreement fee waiver will automatically terminate on October 31, 2020 unless it is renewed by the Adviser. The Adviser may not terminate the fee waiver before October 31, 2020. The total expense ratio excluding the Services Agreement fee waiver for the Institutional Share Class is 1.58%.

Volatility in the market makes investors want to do the wrong thing at the wrong time for the wrong reason. When prices are high and rising, as they have been of late, most investors perceive risk to be declining. The reasoning apparently is that the market has it right, prices are rising, so risk is declining. This false sense of security can cause investors to buy when prices are high.

Conversely, risk is perceived to be increasing when prices are falling. Obviously there is a reason prices fall, but generally speaking, the same company at a higher price carries more risk, not less.

Think of a market cycle. As prices soar and continue to hit new highs, enthusiasm for stocks increases. This can be measured by the amount of money flowing into the stock market. Historically, inflows increase at or near market tops. In other words, the market is likely at its riskiest the last day it hits a new high.

And then prices fall. Investors begin to sell stocks, and the selling accelerates with the steepening of the decline. Perceived risk has increased. Real risk has not. Yet outflows are their greatest at or near market bottoms.

Market volatility can create false perceptions of risk. This often causes investors to ultimately buy high and sell low, never experiencing the true returns of the market. The foxes in the stock market have many tricks to employ to try to do better next time. But they are commonly reduced to trend following and timing. Neither of these appears to us to be repeatable or sustainable.

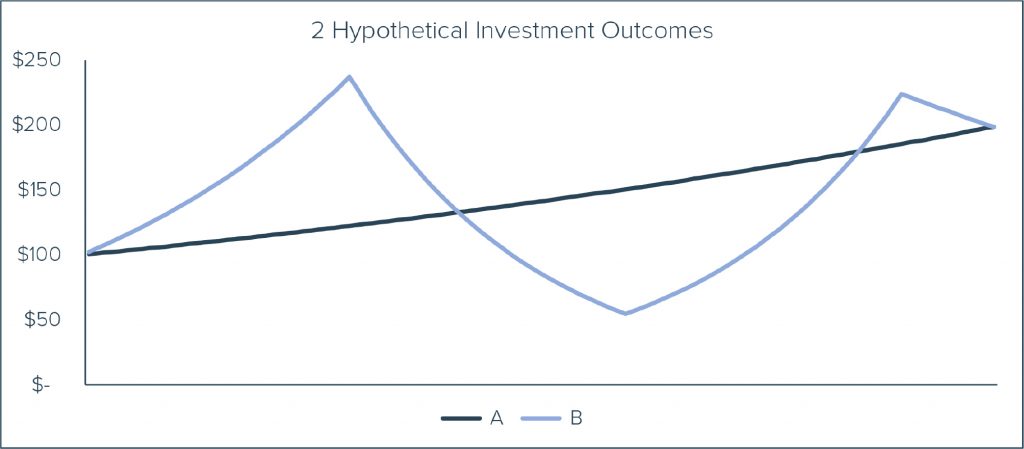

For reference, let us consider the hypothetical investments charted above, noted as A and B. Both investments have identical beginning and ending values. They start with $100 and finish with $200. Similar to the tortoise and the hare (not to mix parables), A runs the steady race while B zips out ahead, falls behind and finally catches up in the end. If you were told with certainty that you could double your money, would you care which investment you chose? Of course not! They result in the same return. Unless, of course, you actually pay attention to the investments.

Imagine that you split $200 equally between A and B. If you did nothing, you would end up with $400. However, as the value of B rises dramatically faster than that of A. aren’t you at least a little tempted to want to move some money out of A and into B? And when B’s decline begins to steepen, don’t you wish you hadn’t done that, and aren’t you tempted to move some money out of B and back to A? Your temptation, with the benefit of hindsight, is to buy high and sell low. This is the exact opposite of what you know to be sound – buy low and sell high. But the volatility gets in the way and clouds your vision. You are not alone! There are many foxes out there.

The hedgehog knows one big thing. By maintaining focus on the one big thing, the hedgehog is only interested in buying low and selling high. She is content to be different from all the foxes, if she is even aware of them. Buy low, sell high, have patience, be willing to hold cash when no alternatives present themselves, reduce volatility, stay invested, repeat.

Tandem’s hedgehog philosophy allows us to focus solely on what we believe to be important. You may not agree with us as to what is important, and that is fine. There is more than one way to skin a cat. But for us, we are not interested in timing the market, following trends or investing in momentum. We simply identify companies that meet our criteria, buy the stock of any that we consider to be unsustainably inexpensive and reduce our ownership in any that we view to be unsustainably expensive. We eliminate any companies from the portfolio that cease to meet our investment criteria.

When prices are low, we often see this as an opportunity to add some risk to the portfolio. We do so by investing some of a portfolio’s cash reserves into the stock of a company that meets our criteria and has a valuation that our math tells us is low.

We perform this discipline one stock at a time, without a view of the market that informs us. We are merely making an unemotional, unbiased decision on a company, based upon our math.

The reverse is true when we believe a company’s valuation reaches what our math tells us is an unsustainably high level. We attempt to reduce portfolio risk by taking profit in overvalued securities while the prices are high. We invest the proceeds in the portfolio’s cash reserves until better opportunities present themselves. Thus, we hopefully succeed in selling high, having patience, and buying low – just as it is supposed to be.

We take these actions proactively, not in response to market events. Our decisions are informed by the specifics of a company, not an opinion or an emotion. We are not following trends or public opinion. Those things have no place in our methodology. In fact, we often find ourselves at odds with ‘prevailing wisdom’.

A client once observed that Tandem is both aggressive and defensive. To that we say emphatically – Exactly! Risk is fine when we believe the odds are in our favor. Risk should be reduced when we believe the odds are not.

Most investors measure return only on an absolute basis: Your returns are better than mine, so you win. It shouldn’t be that simplistic. If your returns were achieved with a high degree of risk, are the returns commensurate with that level of risk? Winning the lottery produces a tremendous payoff. Yet the likelihood of a successful outcome when “investing” in lottery tickets is limited. If you buy $50 worth of lottery tickets every week for 50 weeks you will “invest” $2,500. Winning $1,000 might provide a thrill, but not a reasonable return when adjusted for the level of risk you assumed.

In short, while most market participants rely upon varying metrics, Tandem’s notion of investing is to rely upon the simple notion of reversion to the mean. If valuations are high, risk is rising and this trend will ultimately result in reverting back to a more normalized valuation. Sell when prices are high. If valuations are low, buy and capture the price rise as valuation becomes normalized over time. It is that simple. We know one big thing. And hopefully it produces consistent, repeatable, less volatile results for our clients.

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877-743- 7820, or visiting www.castleim.com. Read it carefully before investing. Distributed by Rafferty Capital Markets, LLC Garden City, NY 11530.

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Comments are closed.