The Bull is Dead. Long Live the New Bull!

April 27, 2020

What was perhaps the most unloved bull market of all time has come to an end.

Fueled by bailouts, buybacks and Federal Reserve largesse, the bull never really seemed to gain the conviction of individual investors. As a result, the euphoria present at the end of most bull markets never quite materialized. There was some panic selling at the end, but little panic buying preceding the fall. Now that bailouts and Fed largesse are back in play, has the next bull market already begun?

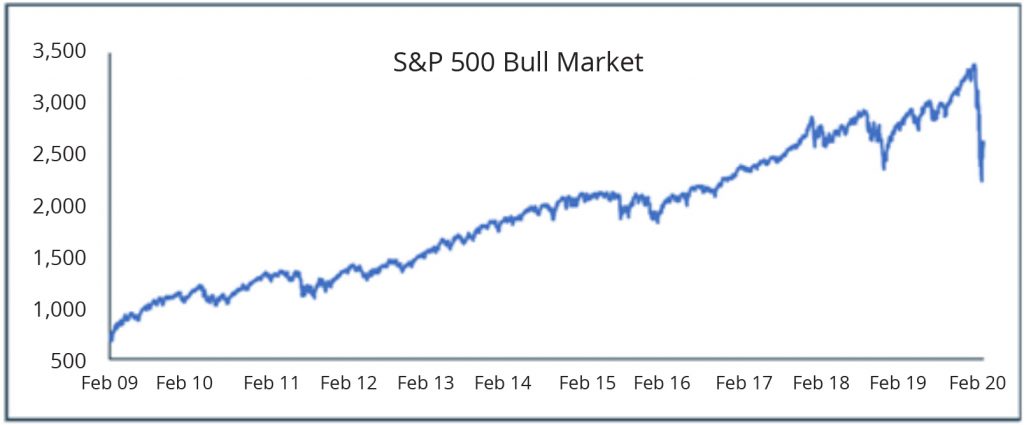

Before we go there, let us first pay homage to the longest running bull on record. From its inception, which was the 3/9/2009 closing low during the Financial Crisis, the S&P 500 advanced 400.52% to its ultimate peak on 2/19/2020. While not a record advance, it was still impressive and rewarding. And then it was over in the blink of an eye.

We entered the New Year on quite a run. The S&P 500 was up over 30% in 2019, and began 2020 by extending its record streak. After hitting its final all-time high on February 19th, COVID-19 brought everything to a crashing halt. By March 23rd, just more than a month after topping, the S&P 500 had fallen 33.92% – a steep decline in a short period of time. Over a period of only 13 days in March, the market fell by more than 30%. The speed of the descent, combined with the collapse in the price of crude oil, as well as economic and health uncertainties created by the virus, left many frightened.

Crude’s steep decline compounded economic concerns. Hit by the double whammy of increased supply caused by Saudi Arabia and Russia (presumably to break the backs of U.S. shale producers) and the near-complete disappearance of demand, a barrel of oil declined from around $64 in early January to nearly $21 by the end of March. Increased supply and decreased demand is a deadly combination for price, and trading of crude reflected this.

No asset class was spared. Even cash had a moment of liquidity concern, as panic temporarily increased demand for cash far beyond available supply. For the first time, albeit briefly, negative interest rates were visited upon the U.S. Once again, the Federal Reserve came to the rescue. Learning from the Financial Crisis, the Fed moved exceedingly quickly to backstop cash and fixed income markets. In a reasonably short period of time, the markets have been calmed and the S&P 500 has gained back some lost ground.

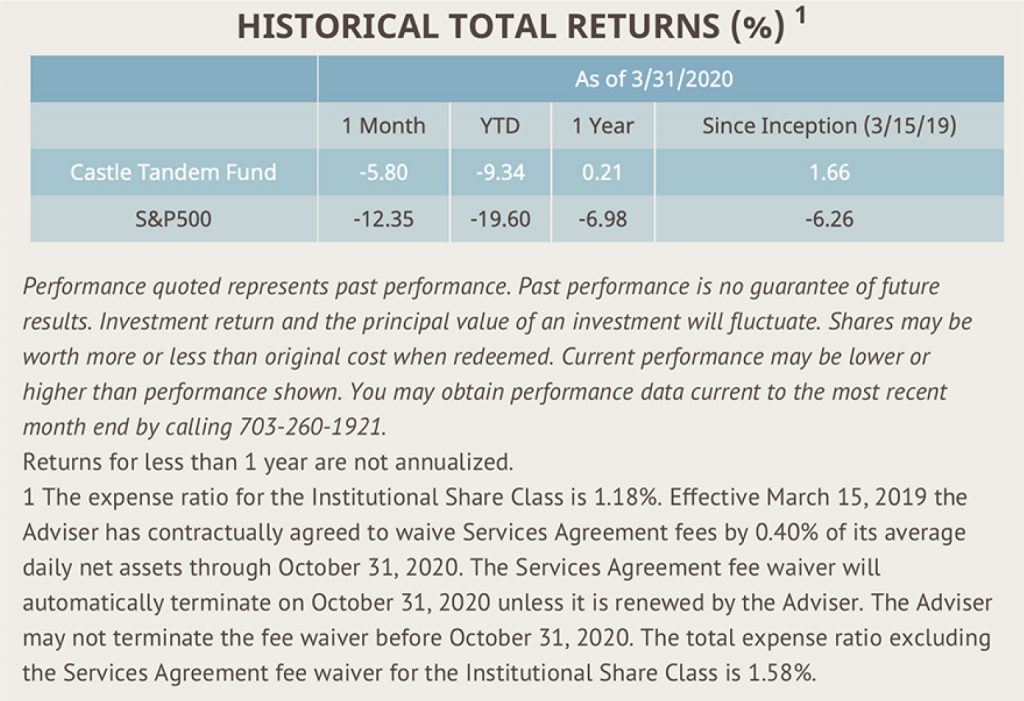

For the quarter, the S&P 500 declined 19.60%. To most it felt worse. Chaos ruled the market for much of March, and the word “unprecedented” became the most overused word in the English language. The S&P 500 saw its worst two days since 1987 (-11.98% and -9.51%), while also experiencing two up days in excess of 9%. The standard measure of volatility in the market, the VIX, surpassed its most extreme levels recorded during the Financial Crisis. And worse, financial “professionals” took to the airwaves in full panic mode. It has been reported that one hedge fund manager used CNBC’s air to create a panic selloff that could have netted him a profit. For the rest of them, whether their panic was real or self-serving, they are not experts in science, medicine or data-modeling. They should not be given airtime to share their views on a pandemic any more than Ellen should be given airtime to discuss quantum physics.

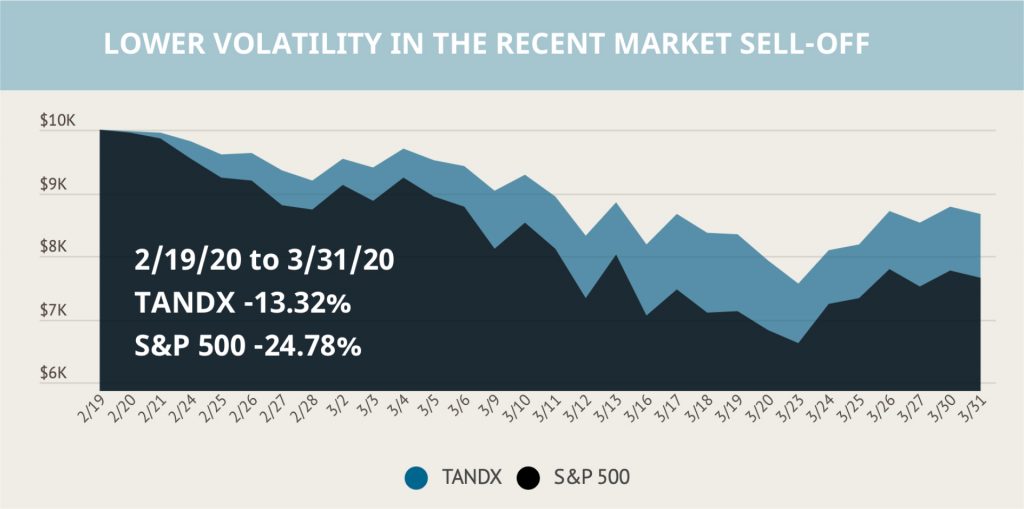

Happily, the Fund experienced a more muted sequence of events. While the S&P 500 dropped 33.79% from February 19 to March 23, the Fund was down 24.33%.

Since bottoming (at least for now) on March 23, the S&P 500 has mostly rallied, rising 15.52% by the end of the month. The Fund did not experience nearly as dramatic a downturn, and we were pleased with its participation in the same snapback rally. It’s path was a little more boring than the market’s, even if it didn’t feel like it at the time.

Throughout 2019, our investment process had us incrementally increasing the Fund’s cash position, culminating in a 23.79% position at year end. By the time the market peaked on February 19th, we had further increased our cash position – the byproduct of selling overvalued securities and not immediately redeploying the capital. As a result, we had cash to use as prices collapsed. Initially this may have made you nervous, but this is what we told you we would try to do – buy low and sell high. Selling high means selling when things seem good and others want to buy. Buying low often means buying when fear is so rampant that others want to sell. In both times, we tend to be contrarian. It can make us look foolish in the moment, but buying low and selling high without emotion is what we are supposed to do.

As for what lies ahead, your guess is probably as good as ours. We are not forecasters or prognosticators. The market’s movements have nothing to do with how we manage the Fund. We make our decisions on individual companies, not market swings. What we have learned from past experience is that in a zero interest rate world, the Fed has the capacity to lift markets.

During the Financial Crisis, through multiple layers of Quantitative Easing, or QE, lasting a number of years, the Fed created about $4 Trillion to backstop markets. Today they have done nearly that amount in less than two months. They mean business. And Congress is throwing money into the ring as well.

Our Federal Government has committed trillions (with a T) of dollars to build a bridge to the return of economic activity. Markets managed to recover quickly from a similar decline in 1987 without all this assistance. Once the virus is safely behind us and life seems normal again, this money is likely to find its way into markets, just as it did the last time. Until then, there will probably be more volatility, and we will do our best to use that to our advantage. Believe it or not, some companies we own have done quite well during this turbulence and have reached prices we believe to be unsustainable. We hope to take some profit in these at the appropriate price and time. Other businesses have done less well in the short run, although we still admire their ongoing prospects. We will try to buy, or buy more of, these companies if their prices fall lower again.

We strive to limit the volatility of the Fund in order to help you stay invested. At the same time, we try to take advantage of extreme volatility in the marketplace by buying low and selling high as opportunities permit. We invested approximately 2/3 of the Fund’s cash reserve when prices were low in late February and early March. We then took some profit at higher prices and replenished some of that cash. The Fund’s cash position on 3/31/20 is nearly less than half what it was at at the beginning of February. We have no idea when it will come, but the seeds of a new bull market are being sown, and we strive to have the Fund ready for it. Thank you for your trust.

The opinions expressed are those of the Fund’s Sub-Adviser and are not a recommendation for the purchase or sale of any security.

The VIX is a market index that measures the expectation of near-term volatility. The Standard & Poors 500 Index (S&P 500) is an index of 500 stocks.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund, and it may be obtained by calling 1-877- 743- 7820, or visiting www.castleim.com. Read it carefully before investing. Distributed by Rafferty Capital Markets, LLC Garden City, NY 11530.

The risks associated with the Fund are detailed in the Fund’s Prospectus. Investments in the Fund are subject to common stock risk, sector risk, and investment management risk. The Fund’s focus on large-capitalization companies subjects the Fund to the risks that larger companies may not be able to attain the high growth rates of smaller companies. Because the Fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large-capitalization companies. Fund holdings and asset allocations are subject to change and are not recommendations to buy or sell any security.

Comments are closed.